A Week in Review: The Tokenization Revolution Gains Momentum

Tokenized Insider Volume 42

In the ever-evolving world of tokenization, the past week has been nothing short of transformative. We've witnessed Backed Finance's ambitious move to bring tokenized versions of traditional assets, like Coinbase's COIN stock, to multiple blockchains, signaling a monumental shift in how high-value asset owners can diversify and leverage their portfolios in the digital age.

Meanwhile, Archax's unveiling of a crypto exchange tailored for institutional investors and Ondo Finance's innovative blend of US Treasuries with tokenized assets have further blurred the lines between traditional finance and the decentralized realm. These pioneering ventures are not only reshaping the investment landscape but also challenging us to reimagine the boundaries of what's possible in the world of finance.

As we delve deeper into this exciting frontier, it's clear that the fusion of real-world assets and blockchain technology is more than just a trend—it's a revolution.

From the streets of Spain with Securitize's tokenized REIT to the innovative corridors of Bridgecoin Capital, which is merging crypto wealth with tangible real estate, the narrative is clear: the future of finance is here, and it's tokenized. As we navigate this dynamic landscape, let's stay informed, stay curious, and most importantly, stay ahead of the curve.

Let’s go!

Mark

“Our current market is suffering from high-interest rates and many commercial banks are pulling out of the capital markets. Tokenization is an alternative financing source that many sponsors will consider because of the options of access, capital raising and liquidity it offers.” - Edward Nwokedi

🔒 NEED TO KNOW 🔒

1. Tokenized Coinbase Stocks Arrive on Polygon!

In a world where high-value assets are the name of the game, Backed Finance (more on them in story #9 below) is making waves by bringing tokenized versions of traditional assets like Coinbase's COIN stock to the blockchain. For my fellow Tokenizers, this move represents a monumental shift in how we can diversify and leverage our portfolios in the digital age. (Yahoo Finance)

2. From Crypto to AI: Gensler's Strategic Shift and What It Means for Investors!

In a surprising move, the SEC, under the leadership of Gary Gensler, is pivoting its attention from the bustling world of crypto to the transformative realm of AI. For all of us interested in tokenization, this signals a potential shift in regulatory landscapes and underscores the undeniable impact of AI on our financial futures. (CryptoSlate)

⚡INVESTMENT OPPORTUNITIES ⚡

3. From Blockchain to Bricks: Dive into Real Estate with PlayEstates' NFTs!

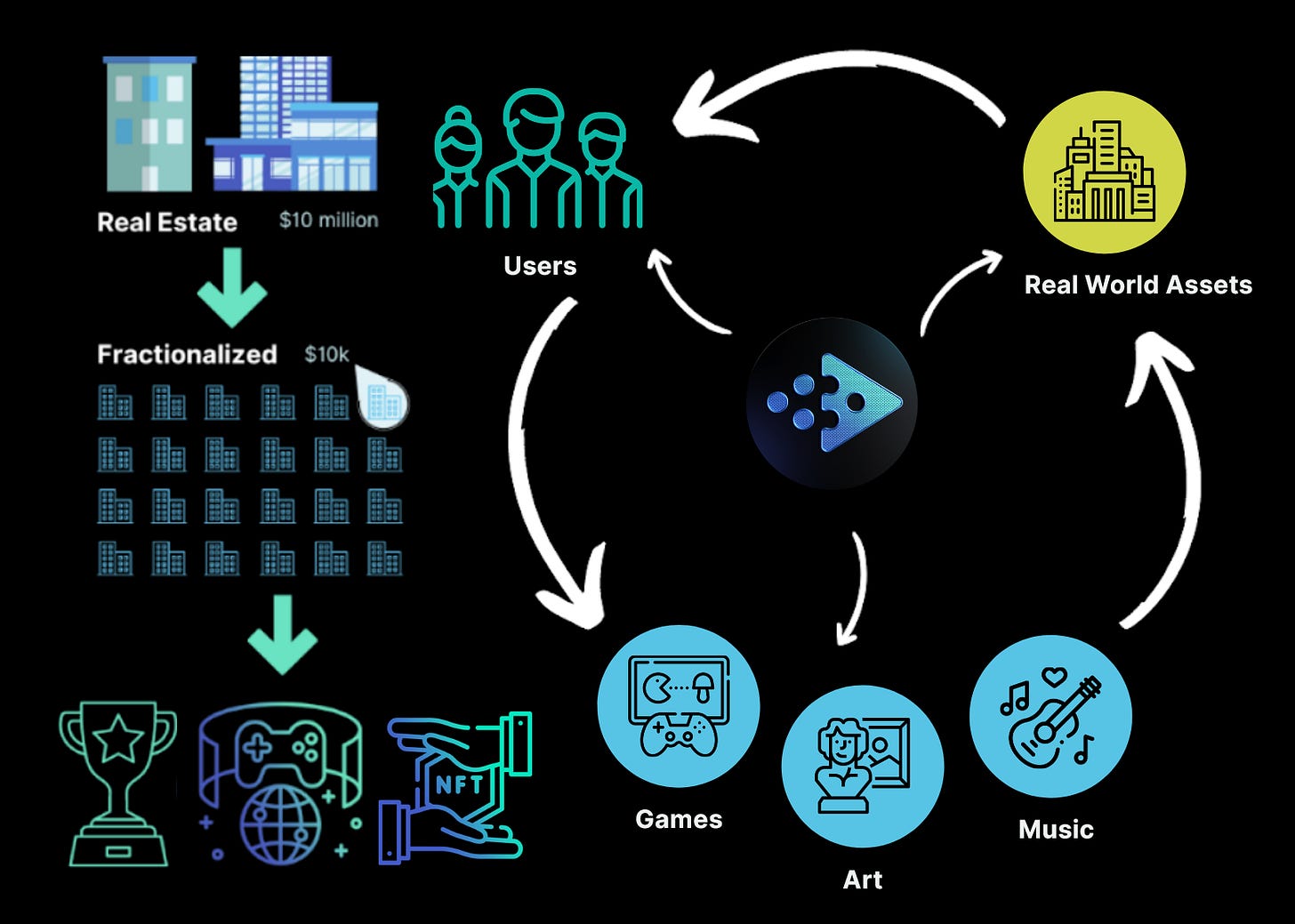

PlayEstates, a REIT-certified blockchain property company, has launched its beta program "EstateLabs." This program has onboarded 10,000 users and experienced peak traffic of 60,000. The initiative aims to educate users about fractionalized real estate investment through blockchain and to build user confidence in the platform. PlayEstates offers fractional ownership of real estate properties through Property NFTs (PNFTs), allowing investments in real estate from as low as $10.

The company has properties worth $23 million in its pipeline and has secured $700,000 in equity funding. They are also collaborating with HaiDiLao Delivery to bridge the gap between the crypto and real worlds.

This presents a golden opportunity for tokenized asset enthusiasts to diversify into tangible assets with minimal entry barriers and the promise of passive income. However, as with all investments, it's crucial to tread carefully, especially given the nascent nature of property-backed NFTs and the volatility often associated with the crypto space.

4. Securitize Breaks Ground with Tokenized Spanish REIT Shares

Securitize is making waves by tokenizing shares of the Mancipi S.A. REIT, a Spanish entity with a keen focus on healthcare commercial real estate. For tokenized asset aficionados, this presents a unique opportunity to tap into the European real estate market, blending the best of traditional assets with cutting-edge blockchain technology.

However, as with all pioneering ventures, it's essential to tread with caution, especially given the regulatory sandbox environment and the evolving landscape of tokenized securities in Europe. (Yahoo Finance)

🏫 TOKENIZATION EDUCATION 🏫

5. Dive into the World of Asset Tokenization with Stobox

Real estate asset tokenization, as detailed by Stobox, is a transformative process where blockchain-based tokens represent shares of ownership in real estate assets, democratizing property investments. This method allows for fractional ownership, enhanced liquidity, and increased security, while also presenting advanced models like the "Raise-then-purchase" and "Segregated Portfolio Company" models to address specific challenges in the sector.

Diving into the world of real estate tokenization, it's evident that we're on the brink of a seismic shift in how we approach property investments. For Tokenizers like us, this means unparalleled access to diversified real estate portfolios, all while enjoying the benefits of blockchain's transparency and security. (Stobox)

6. Deferring Crypto Gains Tax: Bridgecoin's Novel Approach to Wealth Preservation

What do we know? Bridgecoin Capital has launched a unique lending platform that allows customers to lend their cryptocurrency into traditional real estate assets, offering a tax-efficient method to defer crypto capital gains by leveraging real estate.

Why Is It Important? This innovative approach addresses a significant pain point for crypto investors, particularly the capital gains tax, by providing a mechanism to not only defer these taxes but also diversify their portfolios into stable real estate assets, generating passive income.

Why does it matter? For high-value asset owners, this fusion of crypto and real estate signifies a groundbreaking opportunity to optimize their investment strategies, ensuring both tax efficiency and a tangible, secure return on investment.

🚀 TECHNOLOGY SPOTLIGHT 🚀

7. Ondo Finance Breaks New Ground: Merging US Treasuries with Tokenized Assets

What do we know? Ondo Finance, spearheaded by ex-Goldman Sachs associates, has unveiled the USD Yield (USDY), the inaugural tokenized note backed by US Treasuries and bank deposits, targeting non-US investors and boasting an initial annual percentage yield of 5%.

Why Is It Important? This groundbreaking initiative bridges the gap between traditional financial instruments and the digital realm, offering investors a unique opportunity to benefit from the stability of US Treasuries while leveraging the flexibility and potential returns of the crypto space.

Why does it matter? For high-value asset owners, this fusion of traditional and digital finance signifies a pioneering approach to diversify portfolios, ensuring both stability from US Treasuries and the dynamic potential of blockchain technology; however, the exclusivity to non-US investors and evolving regulatory landscape warrant close attention.

8. Archax Breaks New Ground: A Crypto Exchange Tailored for the Institutional Elite

What do we know? Archax, a global digital asset exchange with roots in regulation, has unveiled its 24x7 crypto exchange tailored specifically for institutional investors, offering a seamless trading experience and robust API connectivity.

Why Is It Important? This move by Archax, led by financial market veterans, represents a significant stride in bridging the gap between the traditional investment realm and the burgeoning crypto community, ensuring that institutional players have a platform that aligns with their expectations and needs.

Why does it matter? For high-value asset owners, Archax's launch signifies a pivotal moment, offering a platform that combines the dynamism of the crypto world with the familiarity and trustworthiness of traditional financial systems, but as always, the evolving nature of the crypto landscape demands a keen eye on regulatory and market shifts.

🦄 COMMUNITY SPOTLIGHT 🦄

9. Backed's Bold Move: Expanding Tokenized Real-World Assets Across Six Blockchains

What do we know? Backed, a developer of tokenized real-world assets (RWAs), is expanding its product offerings to six new blockchain ecosystems, leveraging Chainlink's decentralized price feeds to bridge traditional finance and blockchain infrastructure.

Why Is It Important? This move by Backed represents a significant evolution in the DeFi space, providing a seamless interface between traditional financial assets and the decentralized world, thereby expanding the reach and potential of tokenized RWAs across multiple blockchain platforms.

Why does it matter? For high-value asset owners, this expansion signifies a broader horizon for diversifying portfolios, blending the stability of real-world assets with the dynamism of blockchain. However, as with all innovations, the intersection of traditional finance and crypto demands a discerning eye, especially given the regulatory nuances and the complexities of bridging two distinct financial realms.

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.Agency, who has been making waves in the world of crypto and ecommerce for over two decades. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

Let's tokenize together!

P.S. Whenever you're ready, there are 4 ways I can help you:

#1: Ready to grow your personal brand to $5 million or more? Let's chat. >>> Click here to apply for your call with me

#2: Have you seen my YouTube Channel? I'm putting a ton of energy into creating heaps of valuable content that I think you'll like. Come check out my latest Tokenization Videos, and give me a like and subscribe.

#3: Promote your brand to over 5500 subscribers by sponsoring this newsletter.

#4: Follow me on Twitter and LinkedIn for more operating systems, marketing tips, and community-building systems.

One of our best updates yet