5 Big Things to Watch this Week that Don't Include Tom Brady 👀

Tokenization's 5 biggest Stories so far this week

1. Bitcoin Millionaires Now Opt for Real Estate Over Luxury Cars

Real Estate Over Cars: According to this study, Bitcoin millionaires are more interested in sinking their digital gold into real estate rather than flashy cars. This isn't just about living large—it's about smart investment strategies that offer long-term value.

High-Profile Transactions: Major real estate plays are now happening via Bitcoin payments. Notably, Magnum Real Estate Group made headlines as it embraced Bitcoin for a $29M property sale in Manhattan, potentially marking it as the first significant income-producing real estate deal done with cryptocurrency in the U.S.

BitPay's Role: The transactions for these big real estate purchases are facilitated through BitPay, smoothing out the exchange from Bitcoin to USD, ensuring that sellers don't need to worry about crypto's price volatility while cashing out.

A Sign of Crypto Maturing: This trend reflects the growing acceptance and maturation of cryptocurrencies as a legitimate form of payment in high-value transactions, indicating broader market evolution and acceptance.

2. Hong Kong Bank is Looking to Tokenize its Assets

Project Ensemble Launch: The Hong Kong Monetary Authority (HKMA) has initiated Project Ensemble to explore the potential of a wholesale central bank digital currency (wCBDC) to facilitate tokenization of assets like green bonds and other commercial products (Cointelegraph).

Ripple's Participation: Ripple is involved in demonstrating tokenization within the HKMA's digital Hong Kong dollar (e-HKD) pilot program. This includes showcasing real estate asset tokenization to enable equity release (reverse mortgage scenarios) through tokenized assets

Regulatory Framework: Hong Kong's Securities and Futures Commission (SFC) has issued guidelines that treat tokenized securities similar to traditional securities, meaning they are subject to existing legal and regulatory standards. This is part of Hong Kong's broader effort to integrate tokenization with traditional financial systems

Green Bond Tokenization: Under a joint initiative called Project Genesis 2.0 with BIS and the UN, HKMA has been exploring blockchain for green investments, including the tokenization of green bonds to enhance transparency and efficiency in environmental finance

BIS's Continued Involvement: Looking ahead to 2024, the Bank for International Settlements (BIS) plans to further its work on blockchain-based tokenization projects, emphasizing the role of digital promissory notes and exploring the privacy aspects of retail payments using CBDCs

3. Why Tokenization is the Answer to the Real Estate Liquidity Crunch

Real Estate Tokenization and Liquidity: Tokenization in real estate, exemplified by initiatives like Slovakia's Tech Park Ljubljana, uses blockchain technology to enhance liquidity. By converting property ownership into tradable ERC-20 tokens and automating distribution through smart contracts, such projects simplify transactions and broaden market access.

Innovative Resolution and Technology Utilization: The corporate resolution for the Tech Park project was publicly documented via the InterPlanetary File System (IPFS), ensuring transparency and immutability. This resolution underpinned the token issuance handled by the Prop Token smart contract, showcasing the effective use of decentralized technologies in real estate.

Impact on Commercial Real Estate (CRE) Financing: Beyond attracting investors with the potential for returns, the tokenization of real estate is poised to revolutionize the CRE industry. As reported by Reuters, the CRE market recently experienced significant liquidity challenges due to the Fed’s aggressive rate hikes, with even last-resort private lenders imposing high rates. Tokenization could offer new avenues for more efficient and accessible financing in this sector.

Future Potential and Market Evolution: The real estate tokenization market is likely to expand as a key ecosystem for loan borrowers, potentially alleviating some of the liquidity constraints seen in traditional CRE financing methods. This shift could democratize access to real estate capital, particularly in strained financial conditions

4. Swiss National Bank Prefers Tokenized Assets Over CBDCs

Swiss National Bank's CBDC Pilot: The Swiss National Bank is testing a wholesale CBDC focused on interbank transactions to streamline asset settlements. (BeInCrypto)

Operational Feasibility: Project Helvetia confirms the operational and legal feasibility of using a blockchain-based Swiss Franc for interbank settlements.

Strategic and International Approach: Switzerland’s focused exploration on wholesale CBDC contrasts with other regions exploring both retail and wholesale options, aiming to enhance financial market efficiency.

Preference for Tokenized Assets: The Swiss National Bank prefers tokenized assets because they enhance the efficiency and security of financial transactions, aligning with global trends towards digital transformation in financial services.

Future of Tokenization: Successful implementation could revolutionize asset tokenization, providing secure transaction methods for financial markets.

5. The Legal Ownership Rights of Tokenized Commodities In 2024:

Legal and Regulatory Framework: Tokenized commodities must navigate complex legal landscapes, as they fall under existing financial and commodity trading regulations. Compliance is crucial to avoid legal repercussions and ensure operational legitimacy.

Tokenization of Commodities: Tokenizing commodities like gold or oil can enhance liquidity and market efficiency but introduces challenges related to regulatory compliance and market acceptance.

Smart Contracts and Legal Enforcement: The enforcement of agreements via smart contracts in tokenized commodities trading requires clear legal frameworks to address disputes and execution liabilities.

Decentralized and Secure Transactions: Blockchain technology ensures decentralized and transparent record-keeping, reducing fraud risks and enhancing transaction security, which is vital for high-value commodities.

Read the full article here.

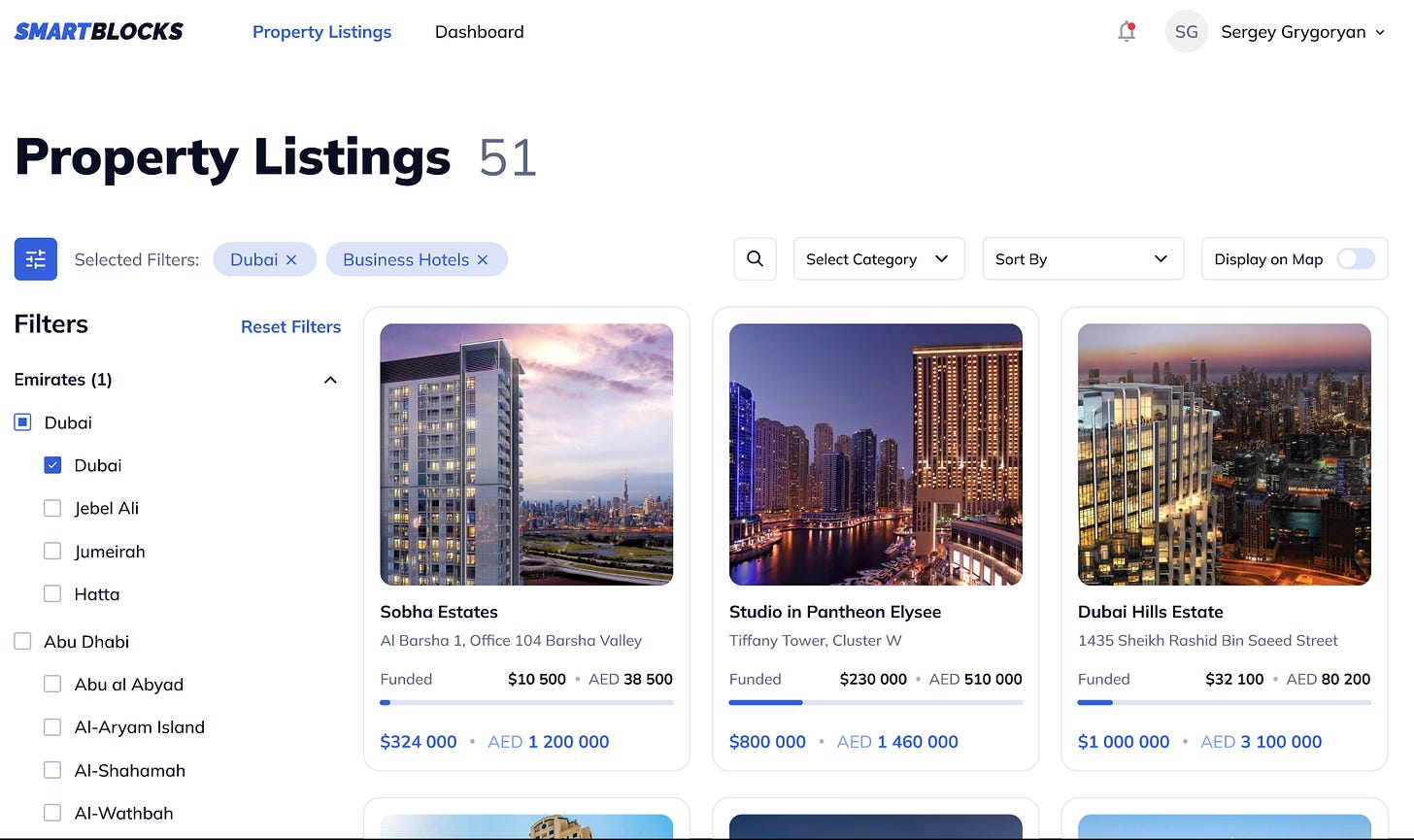

Brought to you by SmartBlocks.xyz