UFC Fights and Hilton Hotels Enter the Blockchain Arena

Tokenized Monday Manifest

1. SEC sets sights on Uniswap: A DeFi crackdown?

The SEC has thrown a curveball at the decentralized finance (DeFi) world by issuing a Wells Notice to Uniswap, a leading DeFi platform. This move marks a significant escalation in the regulatory scrutiny of the crypto sector, particularly DeFi. Uniswap CEO Hayden Adams didn’t mince words, expressing his frustration and readiness to contest the SEC’s claims.

This legal challenge has stirred up considerable debate within the crypto community. Many view it as an unfair targeting of Uniswap, especially considering the SEC's recent actions against other crypto giants like Coinbase and FTX. The outcome of this confrontation could set a precedent for the regulation of DeFi platforms and potentially reshape the future landscape of cryptocurrency.

DeFi in the crosshairs: As the battle lines are drawn, the crypto community watches closely, knowing the ripple effects of this case could be profound.

2. Home Sweet Home? More like Home Sweet Impossible

Bankrate's latest survey reveals a stark reality: 1 in 5 aspiring homeowners believe they'll never own a home. It's a tough market, especially for younger Americans. The numbers tell the tale of escalating challenges—median home prices now hover around $402,000, requiring a hefty annual income of about $111,000 to make the dream of homeownership a reality. That's a whopping 46% increase in needed income since 2020!

The situation is even more daunting in the West and Northeast. States like California, Hawaii, Massachusetts, and Washington D.C. demand incomes ranging from $157,000 to $197,000. With wages lagging far behind rising home prices and interest rates, many are turning towards multifamily housing as a more attainable investment.

Looking ahead: As single-family home affordability wanes, the multifamily sector shines brighter for investors, anticipating continued growth in demand.

🦄 COMMUNITY SPOTLIGHT 🦄

🌍 BST Group Explores Global Expansion with Blockchain

BST Group announces a strategic plan to expand globally through innovative blockchain applications, focusing on enhancing operational efficiency.

💰 Tether Develops Custodial Tokenization Platform

Tether introduces a new custodial platform for tokenization, aiming to enhance security and transparency in digital transactions.

🔁 Ondo Finance Tests Instant Conversion Feature

Ondo Finance debuts a feature for instant conversion from BlackRock’s tokenized fund to USDC, demonstrating innovative solutions in digital asset management.

🥊 VeChain and UFC Partner to Tokenize Gloves

In a unique partnership, VeChain and UFC collaborate to tokenize boxing gloves, merging sports memorabilia with blockchain technology.

🏠 Can Blockchain Innovate Real Estate?

An insightful interview explores blockchain’s potential to drive the next innovation cycle in the real estate industry.

🔄 BlackRock Enhances Tokenized Fund Transfers

BlackRock improves its tokenized fund management system, enabling transfers to stablecoin USDC for added flexibility and security.

💸 Investors Convert BlackRock’s Tokenized Assets into Stablecoins

A new feature allows investors to transfer BlackRock’s tokenized assets into Circle’s USDC, highlighting the integration of traditional finance with modern cryptocurrency solutions.

🏨 El Salvador's First Tokenized Debt for Hilton Development

Bitfinex Securities launches El Salvador’s first tokenized debt instrument for a Hilton hotel project, pioneering new funding methods in Central America.

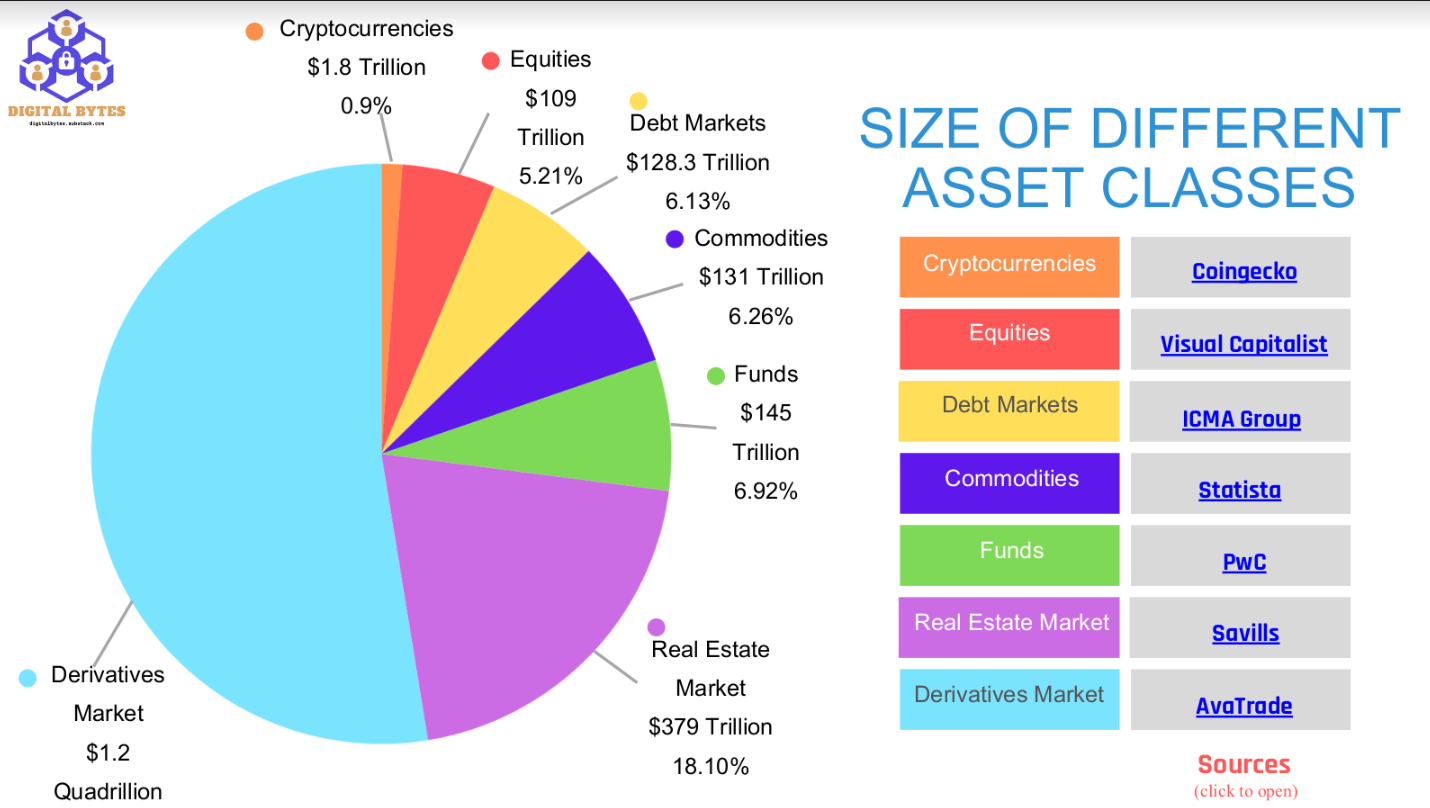

3. Did You Know? A Peek into Asset Class Sizes

Ever wondered how the world’s wealth is distributed across different asset classes? Once you read below, you’ll understand why Smartblocks.xyz chose real estate as its asset of choice to tokenize on our platform.

Here’s a snapshot that might surprise you:

Cryptocurrencies: Despite the buzz, they account for just $1.8 trillion or 0.9% of global assets. Still a small player on the world stage!

Equities: A hefty $109 trillion, making up 5.21% of global assets. Stocks are still a favorite for many investors.

Debt Markets: More significant yet, with $128.3 trillion, or 6.13% of the global pie. Bonds and other debt instruments are essential for many portfolios.

Commodities: Not just your gold and oil, but all commodities together are valued at $131 trillion, representing 6.26%.

Funds: Including mutual funds, hedge funds, and more, they total $145 trillion or 6.92%.

Real Estate: The largest tangible asset class at a whopping $379 trillion, which is 18.10% of global assets.

Derivatives Market: The giant among them, with an estimated value of $1.2 quadrillion. Yes, that's quadrillion, accounting for a staggering proportion of global wealth.

These figures not only reflect the vast scale of global finance but also the diversity of options available to investors.

4. Steady as She Goes: Commercial Real Estate Holds Its Ground

March brought a moment of calm in the commercial real estate (CRE) storm, as Green Street's Commercial Property Price Index recorded no change month-over-month—its first plateau since early 2022. Despite the broader trend of declining values, with a 7% drop year-over-year and a steep 21% fall from its peak in March 2022, there are subtle signs of stabilization.

Interestingly, as we explore the tokenization of real estate assets, this pricing stability could present an opportunity. Tokenization could attract a new wave of investors by lowering entry barriers and providing liquidity in a traditionally illiquid market. With the market now "priced fairly versus corporate bonds," according to Green Street's co-head of strategic research, tokenization might just be the innovative twist needed to invigorate investor interest.

Sector spotlight: While office spaces lagged with the poorest performance last month, multifamily, retail, and hospitality sectors all saw slight price upticks, suggesting varied responses to market pressures across different types of properties.

5. Pendle's Bold Leap into DeFi

Pendle is making waves in the DeFi sector, now boasting $4 billion in total value locked. Its unique approach involves tokenizing future yields from DeFi assets, which are split into Principal Tokens (PT) and Yield Tokens (YT). This allows users to lock in yields or speculate on future returns. With tools like Pendle Earn and Pendle Trade, investors can engage in fixed yield strategies or trade yield tokens for higher potential gains, leveraging the platform’s growing integration across various DeFi projects.

For the full story, check out the article on Bankless.

6. Oxbridge Re Holdings Advances Reinsurance Tokenization

Oxbridge Re Holdings and its subsidiary SurancePlus are breaking new ground in reinsurance with their latest Real-World Asset (RWA) tokenization venture, EpsilonCat Re. This follows their successful DeltaCat Re initiative, which delivered impressive returns. Oxbridge Re's approach democratizes access to high-yield reinsurance investments, previously available only to ultra-high net worth individuals. With reinsurance expected to grow significantly, the strategic use of blockchain and tokenization by SurancePlus positions it as a pioneer in the field, attracting mainstream attention and potentially reshaping investment in this sector.

For the full article, visit The Globe and Mail.

7. Crypto’s New Chapter: Wall Street Warms Up to Tokenization

Here are two expert opinions from on the topic of tokenization and its potential impact on financial markets:

Carlos Domingo, CEO of Securitize, highlights the benefits of tokenization, stating it "eliminates capital markets inefficiencies" by reducing the need for intermediaries, thereby streamlining asset transactions.

Stephen Hall, legal director at Better Markets, expresses caution regarding the adoption of blockchain for finance. He suggests that while tokenization could potentially be beneficial, it carries risks that necessitate careful monitoring and regulation due to its limited track record in legitimate finance.

For the full insights, you can read more in the Politico article.

🧭 Tokenization Spotlight 🧭

8. Avalanche Foundation Fuels $50M DeFi Drive

Avalanche Foundation Commits $50M to Expand DeFi Applications

The Avalanche Foundation allocates $50 million to bring decentralized finance to a broader audience.

Emphasis on enhancing user accessibility and security in the DeFi sector.

9. SWIFT Advances CBDC Interoperability Through Sandbox Testing

CBDCs: SWIFT Releases Findings of Sandbox Testing for Interlinking Solutions

SWIFT explores new interlinking solutions for central bank digital currencies (CBDCs) to improve global financial transactions.

Highlights the potential for CBDCs to enhance cross-border payments and financial inclusivity.

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.XYZ, who is making waves in the world of Tradfi using tokenization as his battering ram. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

P.S. Whenever you're ready, there are 4 ways I can help you:

#1: Ready to tokenize your business, real estate or assets and its $5 million or more? Let's chat. >>> Click here to apply for your call with me

#2: Have you seen my YouTube Channel? I'm putting a ton of energy into creating heaps of valuable content that I think you'll like. Come check out my latest Tokenization Videos, and give me a like and subscribe.

#3: Promote your brand to over 5500 subscribers by sponsoring this newsletter.

#4: Follow me on Twitter and LinkedIn for more operating systems, marketing tips, and community-building systems.