Tokenized DeFi Disruption: Inside the Rise of Maple Finance, Creditcoin, and Centrifuge

Welcome back to "Tokenized Asset Insider," your go-to source for the latest news and trends in the world of tokenization, written exclusively for family offices, investors, and high-value asset owners

📌 TOP SECURITY TOKENS 📌

Happy Wednesday!

The security token market cap is $16,186,384,249 with the top 5 security tokens still firmly in place Enegra Group, Boss Info AG, Millennium Sapphire, TZero and Farmy AG.

🎢A Wild Ride

Welcome to another edition of Tokenized Assets Insider! Folks, we're sitting on the brink of a financial revolution here. With industry giants like BlackRock jumping on the tokenization bandwagon, calling it a seismic shift for the economy, and Siemens launching its first-ever digital bond, the message is clear: tokenization isn't just knocking on the door, it's kicking it wide open.

Now, HSBC is clearly reading the tea leaves correctly and gearing up for what looks to be an inevitable surge in interest. Citi’s latest report projects the tokenization market to explode from its present value to a staggering $4 trillion to $5 trillion by 2030. That's no small potatoes. It's a testament to the immense potential of converting real-world assets into digital tokens. We're talking increased liquidity, bolstered security, and slashed costs. This is the future, my friends, and it's unfolding before our very eyes. Read more

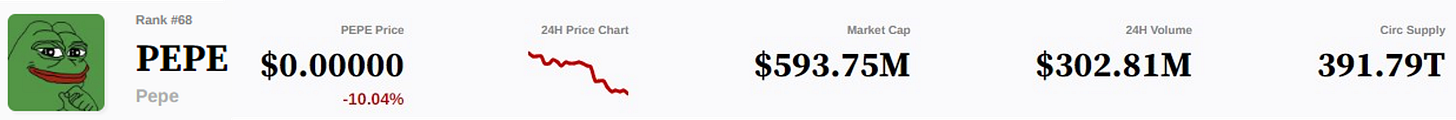

Shifting gears to the wild world of memecoins, we're seeing a fascinating turn of events. PEPE's market cap has taken a nosedive below the $500M mark as traders scramble to swap their positions for the new kid on the block, Milady Memecoin LADYS. PEPE is trading at a whopping 70% off its peak.

It's a clear sign of the fickle nature of the memecoin market, and a reminder that I wrote a long article about why to avoid these meme coins at all costs.

🔒 NEED TO KNOW 🔒

BNY Mellon Entering the Tokenization Market

BNY Mellon, a leading financial institution, is setting its sights on digital assets, with a particular focus on tokenization, heralding it as the "next wave of securitization." The bank, however, is not including cryptocurrency in its current digital asset strategy.

The bank’s strategy involves offering a platform where clients can issue, trade, and settle tokenized assets. The firm believes tokenization will revolutionize asset classes like real estate, art, and intellectual property, by providing increased liquidity, lowering costs, and making transactions more efficient.

⚖ The US Chamber of Commerce Sues the SEC

The US Chamber of Commerce takes a bold stance against the SEC's handling of crypto regulation, backing Coinbase in its fight for regulatory clarity and accusing the SEC of stifling innovation.

Watchdog group Empower Oversight sues the SEC, adding fuel to the fire of scrutiny surrounding the commission's approach to crypto regulation and its potential conflicts of interest.

☛Carlyle-owned Calastone makes the case for fund tokenization

Fund network Calastone successfully tests blockchain-based solution for tokenizing fund units, aiming to enhance liquidity, reduce costs and improve accessibility for retail investors.

📑SURVEY: Over 90% of institutional Investors interested in investing in Tokenized assets

A new survey reveals that over 90% of institutional investors are considering investing in tokenized digital assets, signaling a shift towards embracing this new asset class.

The increasing interest in tokenized assets is driven by their benefits including improved liquidity, fractional ownership, and cost-effective transactions, promising to revolutionize traditional investment strategies.

⚡INVESTMENT OPPORTUNITIES⚡

Tetraguard Crypto ETF

TetraGuard, a new investment product, has been introduced as a safe haven in times of market volatility. It is a cryptocurrency basket designed to provide stability by diversifying investments across multiple top-performing cryptocurrencies.

The crypto basket's performance is linked to a custom index composed of Bitcoin, Ethereum, Binance Coin, and Chainlink. These cryptocurrencies have been selected due to their strong fundamentals, large market capitalization, and significant daily trading volumes.

TetraGuard's primary advantage is risk mitigation. By spreading investments across multiple cryptocurrencies, it minimizes the impact of individual crypto price swings, making it an attractive option for investors seeking exposure to the crypto market without excessive risk.

USP Real Estate Token

USP Real Estate token has emerged as a unique, bold, and potentially transformative investment option in the crypto space, backed by real-world assets (RWAs), including real estate properties.

The token offers investors the benefits of blockchain technology, such as transparency and liquidity, while also providing the stability and tangible value of real estate investments, creating a promising combination of traditional and digital finance.

⚖EXPERT INTERVIEWS⚖

Exploring the transformative potential of tokenization, this interview with Henry Chong, CEO of Fusang discusses how this technology can democratize access to various asset classes, enhance liquidity, and usher in a new era of economic inclusivity and efficiency.

In a recent podcast, Jim Strang of HgCapital Trust discusses the accelerating race towards capital tokenization, highlighting its potential to revolutionize asset liquidity, ownership, and the overall functioning of capital markets.

🎉Tokenized Assets Spotlight 🎉

💰DEFI and Security Tokens a Powerful combination

Imagine you've got a schoolyard, and in this schoolyard, kids are trading Pokemon cards. This trading is a lot like how banks and other financial institutions swap money and assets in what's called the traditional financial market.

Now, imagine if you and your friends decide to set up your own trading system on the playground, where you make the rules, and there are no teachers (or banks) involved. That's what DeFi, or Decentralized Finance, is like - it's a whole new playground for trading, but instead of Pokemon cards, people are borrowing against digital assets backed by real world assets (called Security Tokens). Who are the major players today?

Maple Finance is an innovative platform that has devised a system for institutional investors to access undercollateralized loans through lending pools. These pools, managed and underwritten by credit professionals known as pool delegates, offer investors the opportunity to lend their crypto assets and earn yield. To date, Maple Finance has facilitated over $1.8 billion in loans through its platform.

Creditcoin is a credit network primarily geared towards facilitating loans for businesses in emerging markets, including those underserved by traditional banking. The platform reduces verification and risk assessment costs via blockchain technology, creating a transparent credit transaction history that helps lenders make informed decisions. With a focus on empowering investment in RWAs and offering yields up to 20% APR, Creditcoin has facilitated over 3 million transactions valued at $70 million.

Centrifuge broadens the scope of RWA tokenization, encompassing assets like invoices and real estate. Through its marketplace, Tinlake, it allows borrowers to convert their RWAs into non-fungible tokens (NFTs), which can then be used as collateral to create asset pools. This opens up the potential for enormous global markets, such as real estate and corporate debt, to explore RWA tokenization.

🎰Quick Hits🎰

🚦 Florida Governor Ron DeSantis officially bans CBDCs in the state.

🌈 EY launches EY OpsChain ESG to track carbon credits and emissions (Forkast)

🏙 Unlocking The Potential Of Asset Tokenization In Islamic Finance (Forbes)

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.Agency, who has been making waves in the world of crypto and ecommerce for over two decades. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

But that's not all - Mark has also been recognized as a top influencer by Forbes Magazine, named a social media keynote speaker by Inc Magazine, and ranked among the Huffington Post's Top 50 Most Social CEOs. He's even got his own YouTube channel, Cryptonized!, where he shares insights on the hottest crypto trends.

As a globally recognized thought leader on cryptocurrency and ecommerce, Mark has written for Forbes and interviewed hundreds of CXOs from Global 3000 companies. His expertise and experience make him a sought-after speaker and writer, and you can keep up with his latest insights by following him on Twitter at

http://twitter.com/#!/markfidelman