Tokenization’s Trillion-Dollar Future Is Now

$18.9 Trillion by 2033

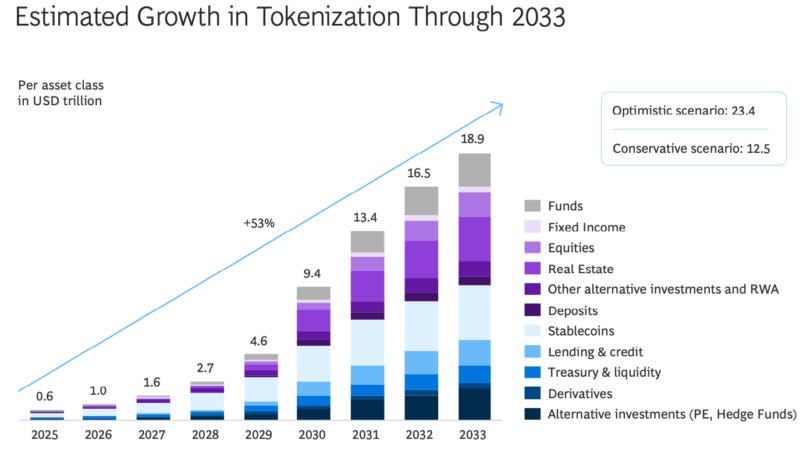

Boston Consulting Group and Ripple just dropped a bombshell prediction: the tokenization of real-world assets (RWA) is expected to hit $18.9 trillion by 2033.

Let that sink in.

The report outlines how everything from real estate to equities and debt is moving on-chain. Why? Because blockchain solves three of the biggest pain points in traditional finance: liquidity, transparency, and accessibility.

Here’s what stood out:

🔹 Massive Upside: Today’s tokenized market sits at just $2.5B. That means we’re talking about 7,500x growth over the next decade.

🔹 Leading Use Cases: Real estate, private equity, bonds, and carbon credits are set to dominate tokenized asset classes.

🔹 Early Mover Advantage: Infrastructure is maturing fast—those building now will own the rails tomorrow.

For SmartBlocks, this is rocket fuel. Our focus on tokenized debt and AI underwriting couldn’t be more perfectly timed. If you’re not preparing for this shift, you’ll be left behind.

The tokenization era isn’t coming. It’s here.

Check out our featured Real Estate Fund

The first tokenized Real Estate fund for San Diego

Hey Mark,

Just wanted to say — well done! You're doing a great job pushing the real estate tokenization space forward. Your insights and reports are not only informative but also genuinely valuable for the industry. We need more people like you leading the charge. Keep it up!