Tokenization and the New Era of Wealth Creation

Welcome back to "Tokenized Asset Insider," your go-to source for the latest news and trends in the world of tokenization, written exclusively for family offices, investors, and high-value asset owners

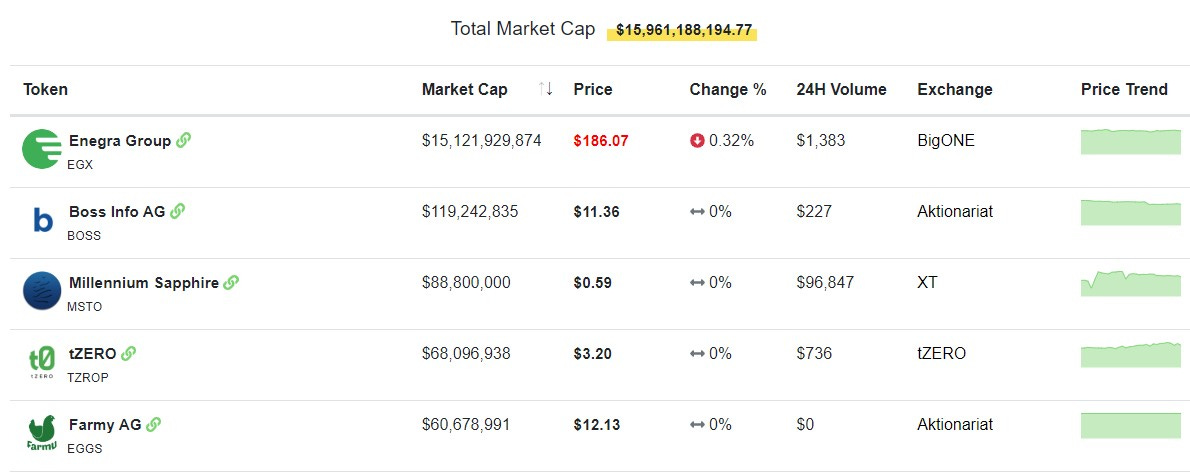

📌 TOP SECURITY TOKENS 📌

Liquidity crisis

In a remarkable move, Sequoia Capital recently permitted its limited partners to withdraw capital early from its evergreen fund, the Sequoia Capital Fund, amidst a downturn in equity prices causing liquidity issues for many institutional investors.

Launched in October 2021 during the peak of an unstoppable bull market, Sequoia's innovative fund structure aimed to hold public stocks longer, while still committing to a two-year lockup period.

However, it's essential to note that not all funds will follow Sequoia's footsteps, making investment in projects like security tokens an attractive option due to their inherent liquidity advantages.

🔒 NEED TO KNOW 🔒

Both Cantor Fitzgerald and Northern Trust State ‘Tokenization is the Future’

Justin Chapman, global head of digital assets and financial markets at Northern Trust and Elliot Han, head of crypto, blockchain and digital assets investment banking at Cantor Fitzgerald, explain how Tokenized assets are revolutionizing the financial landscape by providing investors with more data, insights, and transparency about their investments, emphasizing the importance of data-driven decision-making. With increasing excitement and diverse use cases, tokenization is poised to become the baseline for various assets such as real estate and securities, opening up new opportunities in the market. (Video)

☠Crypto Meme Hangover

When you bet your dignity on meme coins and forget the hangover from the last meme crash.

Our Take ➞ The unbridled madness of cryptocurrency has swept up unsuspecting dreamers into a whirlwind of get-rich-quick Ponzi schemes, where a heartbreaking 95% ultimately lose their hard-earned money. Frankly, it's about time we put an end to this reckless gamble.

I wholeheartedly champion the cause of security tokens, a beacon of stability and regulation in this financial wild west. High-net-worth investors and family offices, take heed: turn your backs on these perilous schemes and seek refuge in the haven of well-governed, secure assets. Let's put our collective foot down and demand a responsible, trustworthy financial landscape.

🏙More Real Estate Developers tokenize their properties

Mitsui Fudosan, Japan's leading real estate developer, explores tokenization of real estate properties to boost liquidity and transparency.

Collaborating with LayerX and ConsenSys, Mitsui aims to create a digital securities platform for real estate assets.

The partnership seeks to revolutionize the property investment landscape, making it more accessible and attractive to a wider audience.

Our Take ➞ Giving investors access to these previously closed-off investments brings secondary market liquidity to current investors and it allows mom-and-pop investors to get in on the game previously reserved for the ultra-wealthy. The extra investors are easily and automatically managed by rules embedded in the smart contracts embedded in the security token and the blockchain.

📑Latest company to Tokenize their equity

Blocktrade takes a strategic approach by tokenizing its equity to enhance liquidity for its 5,000 shareholders, utilizing Tokentrust AG's specialized platform.

The tokenized shares adhere to the European Union's regulatory framework, ensuring compliance and providing a reliable trading environment on Blocktrade's platform.

This innovative decision not only broadens access to capital markets but also simplifies the trading process for company shares, demonstrating the potential of tokenization in the financial sector.

Our Take ➞ Let me break it down for you, my friends. If you're a company owner in need of liquidity, issuing security tokens as equity is a fantastic way to raise funds without drowning in debt. And here's the cherry on top: investors absolutely adore it because they can trade these tokens on secondary exchange markets. It's a win-win situation for everyone involved!

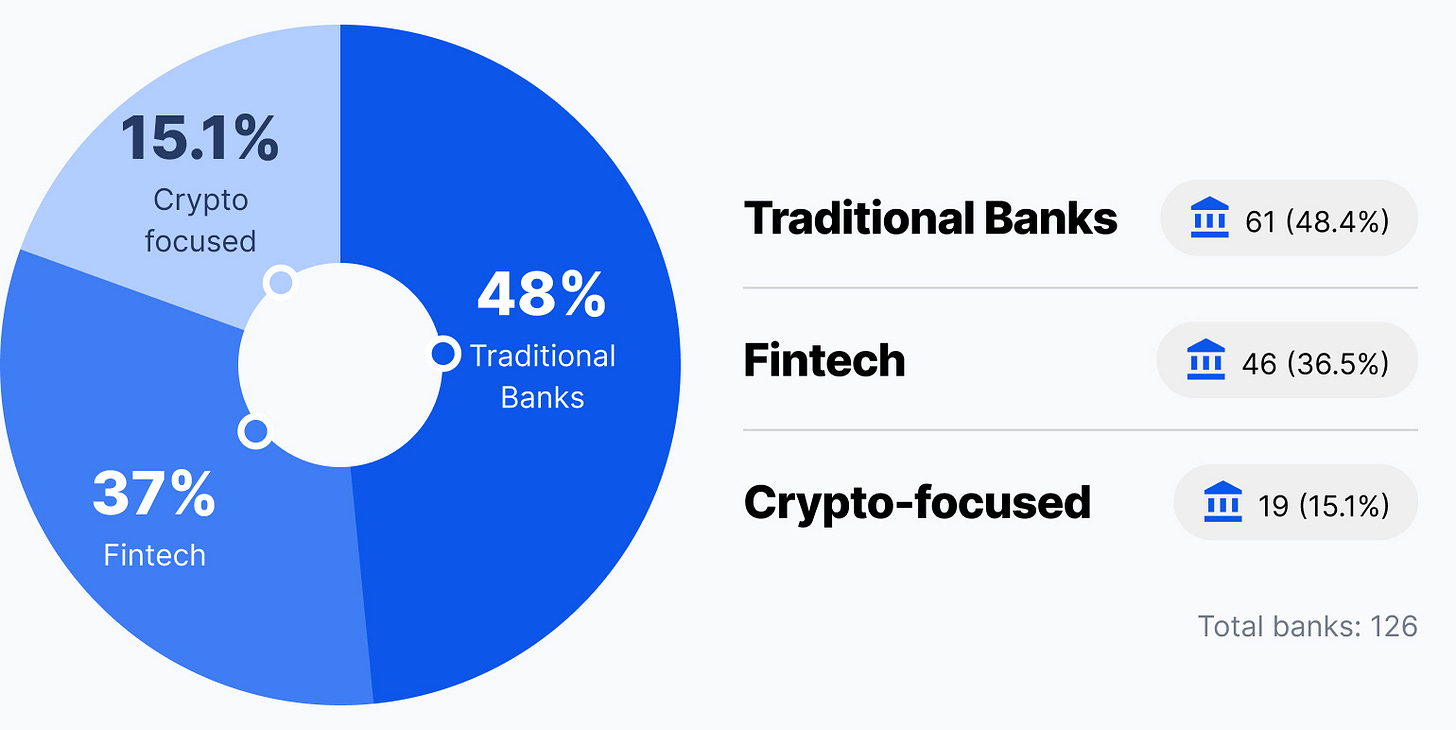

💰Global Crypto Banks Are Growing

Crypto-friendly banks categorized into three groups: traditional banks, fintech/digital banks, and crypto-focused banks.

Currently, 61 traditional banks, 46 fintech/digital banks, and 19 crypto-focused banks provide services to the crypto industry.

Mainstream banks are adapting to crypto, while fintech players and crypto-focused banks offer specialized services for the evolving market.

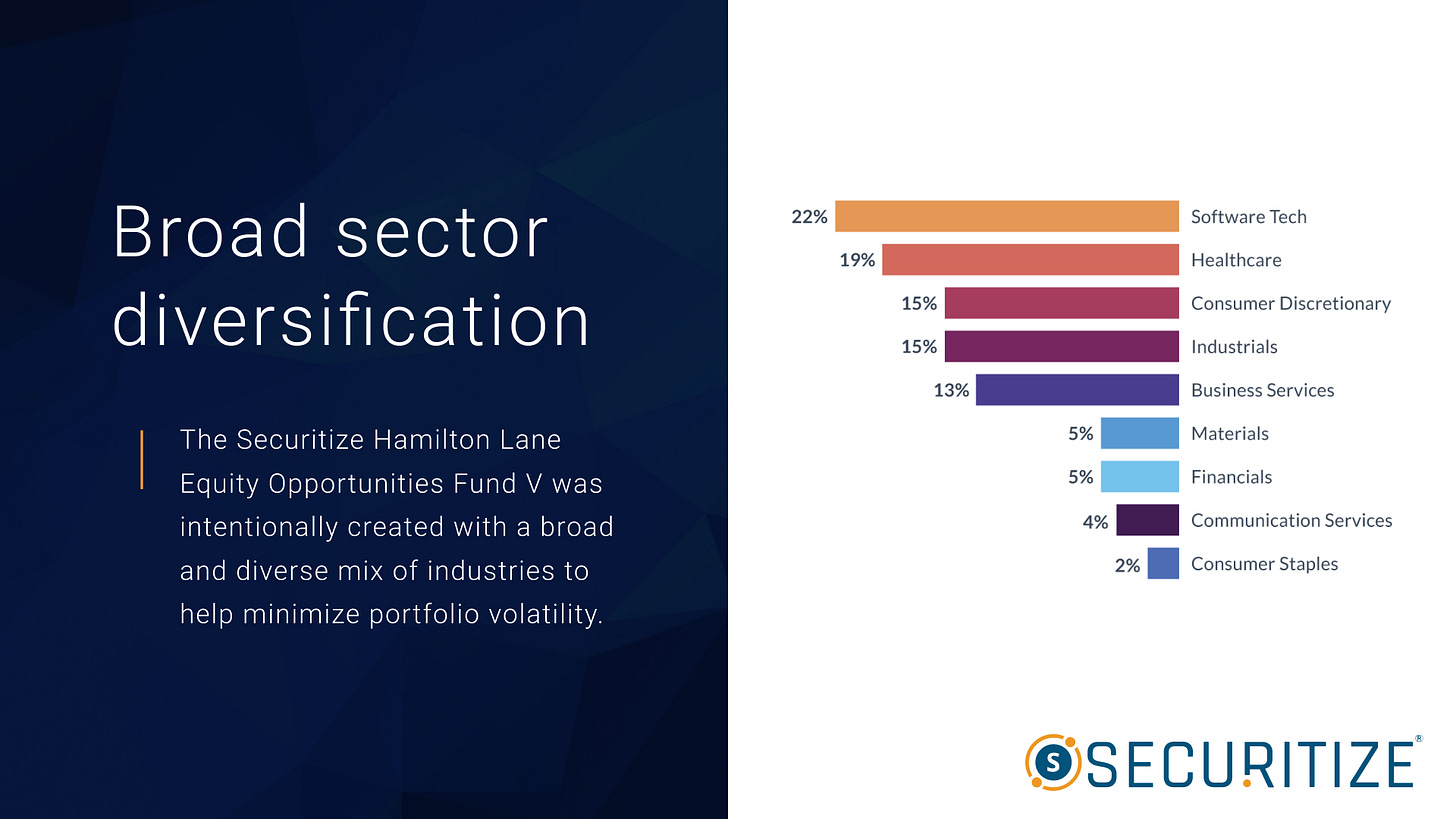

📈 Hamilton Lane (Nasdaq: HLNE) Tokenizes part of their fund

Securitize, the digital securities maestro, expands liquidity potential for Hamilton Lane's Senior Credit Opportunities Fund.

This partnership opens the doors for accredited investors invest in a private credit investment, previously reserved for a “members-only” club.

The vehicle offers immediate deployment of investor’s capital with a reduced minimum investment of $10,000, from $2 million from the member’s only club

Our Take ➞ Mark my words, folks, this is just the beginning. Just as Sequoia's liquidation offer to LP’s above, tokenization gives all investors that option from the beginning. Honestly, it's challenging to spotlight only a few of the future use cases. But imagine a private fund offering the same flexibility as Nordstrom's return policy. By providing investors with more options post-investment, such as exiting the fund whenever they please, we can attract a broader range of investors. That's the beauty of tokenization – expanding opportunities for all

⚡INVESTMENT OPPORTUNITIES⚡

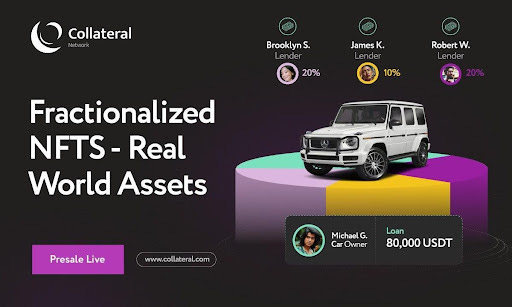

1. Collateral Network (COLT)

if you've been on the hunt for a tokenization project in the presale stage that's oozing with so much potential it could flip an entire industry on its head, then allow me to introduce you to the Collateral Network. This trailblazing venture is constructing a fractional NFT lending platform that lets people transform their real-world treasures – from real estate to cars, fine art to jewelry, and even those precious bottles of fine wine – into non-fungible tokens that can secure loans.

2. C+Charge (CCHG)

Folks, let me introduce you to one of the hottest presale tokens worth considering:

C+Charge (CCHG). Green blockchain and cryptocurrency projects like this gem are riding the wave of surging global interest in sustainability.

C+Charge weaves together a captivating concept to bridge the gap between EV charging stations and carbon credit ownership. Electric vehicle drivers, rejoice! You can earn tokenized carbon credits simply by charging up at partner stations.

And here's the cherry on top: CCHG tokens will serve as the transactional currency for the C+Charge network, rewarding EV drivers for going green.

🧪EDUCATE ME🧪

🧭Why security tokens will stop the next FTX Debacle

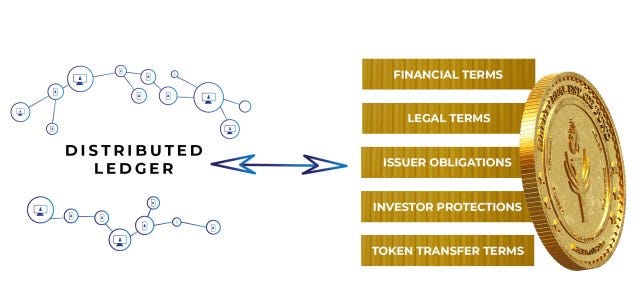

I believe standardized smart financial contracts have the potential to make security tokens much safer than traditional crypto tokens. This is because standardization can foster transparency, efficiency, and regulatory compliance, making it easier for both investors and regulators to understand and assess these tokens' underlying assets.

Moreover, the use of smart contracts can automate various processes and reduce the risks associated with human intervention, while ensuring a more secure and reliable ecosystem for trading and investing in digital assets. In fact, had such standardization been in place, debacles like FTX and Mt Gox might have been avoided, as the enhanced transparency and security measures could have prevented the issues that led to their downfall.

In my opinion, the adoption of standardized smart financial contracts is a significant step towards a safer and more robust security token market. (READ)

💲Unleashing the Real Monopoly on Wealth Creation

In an era of digital transformation, tokenization is poised to redefine industries by converting tangible assets, such as real estate and fine art, into tradable digital tokens. By fostering fractional ownership, liquidity, and access to previously illiquid markets, this cutting-edge technology harbors the potential to revolutionize traditional financial markets, level the playing field for wealth creation, and unveil unprecedented investment prospects—all while challenging conventional norms and procedures.

🦄Who wants to be a Billionaire?

Get ready for the biggest tech roller coaster ride in history! 🎢 Blockchain is poised to disrupt trillions of dollars 💸 and rope in billions of users. Industries beware, the blockchain tsunami 🌊 is on the horizon, set to create new billionaires and reshape the global economy. Fasten your seatbelts, folks! (Read)

⚖EXPERT INTERVIEWS⚖

Interview: Why this real estate developer is tokenizing

CEO of Hazelton Group, a company specializing in mid-rise residential condominium projects.

Aside from his role at Hazelton Group, Bhaktraj Singh is involved in the technology sector and is preparing to launch a Tokenized Asset Offering under Digital Block, a security token offering platform based on ERC 20 tokens. Catch the Interview

🏙OFFICE REAL ESTATE 🏙

Towering Discounts: The Sky-High Fall of San Francisco's Office Real Estate

1. Downtown Dilemma: San Francisco's once-thriving office tower at 650 California St is set to sell for a massive discount, a jaw-dropping sign of the times in the post-pandemic world.

2. Real Estate Rollercoaster: From a staggering pre-pandemic price of $850 million, the 34-story tower's sale price is now expected to be around $450 million, reflecting the dramatic shifts in the market.

3. Work from Home Woes: With remote work becoming the new normal, commercial real estate faces an uncertain future, forcing owners and investors to adapt and rethink their strategies in a rapidly evolving landscape.

Our Take ➞ Commercial office properties in cities everywhere are in a world of hurt. And to add insult to injury, there's a staggering $3 trillion in debt due in the next few years. So, what's a commercial real estate owner to do? I'd say one option they should seriously consider is tokenization. It's time to think outside the (big) box!

Here's a link to our ebook on how we help real estate owners tokenize their properties.

🎉TOP STORIES 🎉

1. Arthur Mackenzy Group, a real estate investment company, recently announced their decision to tokenize their properties in Dubai with the help of KXCO blockchain-based real estate platform — Read

2. A ‘Credit Crunch’ Is Looming. Here’s How It Could Affect Your Wallet — Read

3. Curve Deploys Stablecoin Smart Contract on Ethereum — Read

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.Agency, who has been making waves in the world of crypto and ecommerce for over two decades. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

But that's not all - Mark has also been recognized as a top influencer by Forbes Magazine, named a social media keynote speaker by Inc Magazine, and ranked among the Huffington Post's Top 50 Most Social CEOs. He's even got his own YouTube channel, Cryptonized!, where he shares insights on the hottest crypto trends.

As a globally recognized thought leader on cryptocurrency and ecommerce, Mark has written for Forbes and interviewed hundreds of CXOs from Global 3000 companies. His expertise and experience make him a sought-after speaker and writer, and you can keep up with his latest insights by following him on Twitter at

http://twitter.com/#!/markfidelman

.