The Week Real Finance Quietly Went Onchain

If you blinked this month, you probably missed it.

Not because nothing happened.

Because the biggest shifts in tokenization rarely arrive with hype.

They arrive with approvals, infrastructure upgrades, and banks quietly doing things they told you last year they would never do.

Here is what actually mattered this week and why it signals a real change in how capital is going to move in 2026.

SmartBlocks Deal of the Week:

Earn 10% Secured Yield From Essential Bay Area Memorial Infrastructure

Monte Vista Memorial Gardens is a 46-acre, fully entitled memorial park, funeral home, and crematorium project in Livermore, California, financed through a 10% first-lien senior secured note.

10% fixed annual interest, paid quarterly

3-year term, interest-only

First-lien senior secured position

Approx. 34% loan-to-value based on a ~$52.2M appraised collateral base

1. The SEC Just Gave Institutional Tokenization a Playbook

On December 11, the SEC issued staff no action relief to DTC for a tokenization pilot that does something critical.

It allows real world security entitlements held in DTC custody to be represented on approved blockchains, with compliance, reporting, and investor protections intact.

This is not crypto experimentation.

This is regulated financial plumbing.

Participants can voluntarily elect to convert entitlements into blockchain based representations while DTC maintains its role as intermediary. Custody does not disappear. Compliance does not disappear. The rails simply change.

This matters because it answers the question institutions have been asking for years.

Can tokenization exist inside U.S. securities law?

The SEC just said yes, with conditions.

2. Tokenized U.S. Treasuries Are Moving From Theory to Execution

DTCC has partnered with Digital Asset to bring tokenized U.S. Treasuries to the Canton Network, with a minimum viable product planned for the first half of 2026.

A subset of DTC custodied Treasuries will be minted onchain in a permissioned environment, with DTCC and Euroclear co chairing the Canton Foundation.

This is how institutional adoption actually happens.

Start permissioned.

Start regulated.

Start boring.

Liquidity, settlement speed, and transparency improve first. Broader access comes later.

If you are waiting for public chains to win overnight, you are misunderstanding how TradFi migrates.

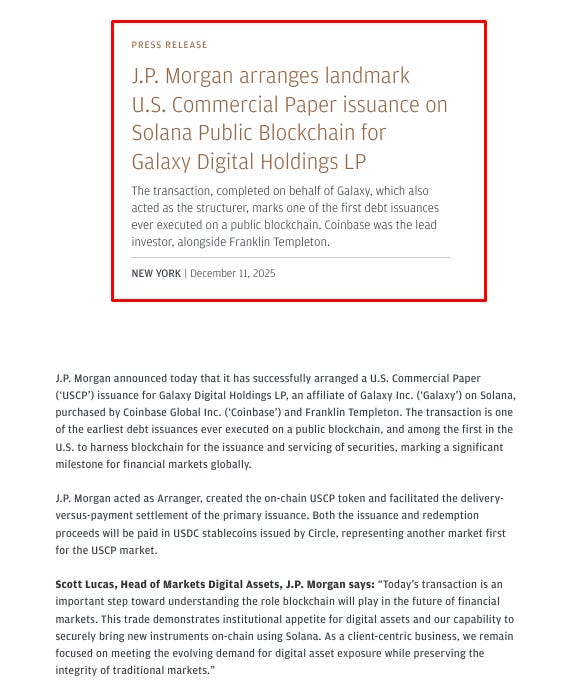

3. J.P. Morgan Just Issued Real Debt on a Public Blockchain

This is the one most people glossed over.

J.P. Morgan arranged a fifty million dollar onchain commercial paper issuance for Galaxy Digital on Solana, settled entirely in USDC.

Coinbase and Franklin Templeton were the buyers.

This was not a simulation. Not a testnet. Not internal only.

Issuance, delivery versus payment, and redemption all happened onchain using a regulated stablecoin.

Major banks are no longer asking if public blockchains are acceptable.

They are deciding which transactions belong there.

That is a very different conversation.

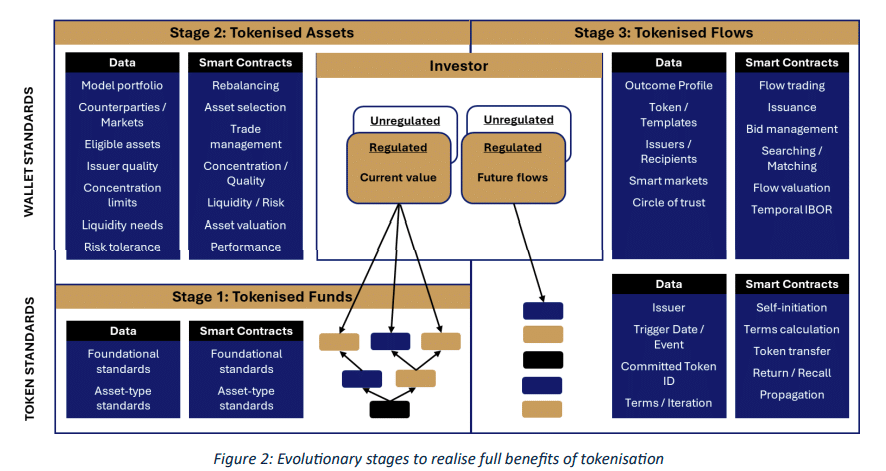

4. What This Means for Tokenized Real World Assets

When you zoom out, the pattern becomes obvious.

Regulators are allowing controlled onchain representations.

Infrastructure providers are building compliant rails.

Banks are executing real transactions where it makes sense.

This is not incremental.

It is structural.

For asset classes like hotels, real estate SPVs, infrastructure debt, green bonds, and data center assets, issuance is about to change.

Due diligence gets faster.

Auditability improves.

Distribution widens without sacrificing compliance.

The winners will not be the loudest token launches.

They will be the structures that clear institutional review with the least friction.

5. More Signals You Should Not Ignore

Standard Chartered launches tokenized deposit rails

Standard Chartered rolled out blockchain based tokenized deposits with Ant International, enabling real time treasury flows across major currencies. This replaces batch settlement with always on liquidity while staying fully bank grade.

Circle launches tokenized gold and silver swaps

CircleMetals now allows USDC to convert into tokenized gold and silver at live COMEX linked prices. Programmable money just merged with one of the oldest stores of value in the world.

Italy executes its first onchain structured note

UniCredit issued a capital protected structured product on a public blockchain under Italy’s FinTech Decree. This was not a pilot. It was a live issuance for professional clients.

These are not experiments anymore.

They are production systems.

Why This Matters Now

Tokenization is being absorbed into the existing financial system, quietly and deliberately.

The real question for investors is no longer whether tokenization works.

It is where exposure makes sense.

Owning applications is optional.

Owning the rails, the assets, and the structures underneath them is not.

2026 will reward people who understood this shift early.

If you are building, investing, or underwriting in this space, now is the time to rethink your assumptions.

The infrastructure is arriving whether the narratives catch up or not.

Until next week,

Mark