The Top 32 Tokenization Experts You Need to Know

A newsletter for tokenization owners and investors

Buckle up, folks, because I've got some real treasures for you in this newsletter! No, seriously, literal shipwreck treasures and an immersion into the enticing world of tokenization, it's like Indiana Jones met the Matrix.

In this edition, we're diving (pun totally intended) into the Who's Who of tokenization, spilling the tea on the current kerfuffle in commercial real estate, and shining a spotlight on some really cool investment opportunities that might just be your next golden goose - or in this case, golden token. Remember, you heard it here first when your portfolio starts to look like it discovered El Dorado!

Don't miss the boat on these waves of information - the future of investing is here and it's flashing brighter than a treasure chest full of precious doubloons!

📌 TOP TOKENIZATION INFLUENCERS📌

I've been doing my homework, researching, and reading up on the big movers and shakers in the tokenization world. I've been so impressed by their content, and I believe you'll find their insights as enlightening as I do. So, without further ado, here are some of the people you should be following:

🦄 See the entire list 🦄

🔒 NEED TO KNOW 🔒

📈1. Commercial Real Estate is in Trouble, Here’s What To Do:

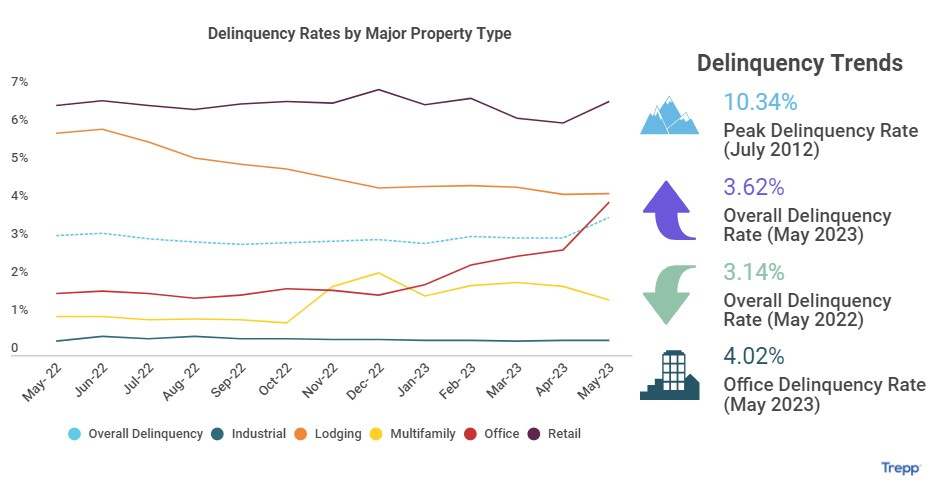

Recent data from Trepp indicates a spike in the delinquency rate for Commercial Mortgage-Backed Securities (CMBS) to 3.62% in May. This is the highest we've seen since March 2022 and it seems to be largely due to a combination of increasing rates and sluggish demand for office spaces.

In terms of specifics, the delinquency rate surged by 53 basis points last month, marking the sharpest rise since June 2020. A significant contributor to this was a 125 basis points leap in office delinquencies. The rate of office delinquencies now stands at 4.02%, a figure not seen since 2018. It appears that a number of firms are aggressively downsizing their workspace requirements, and the volume of office space available for sublease has surged to near record highs in many markets.

So what does this mean for real estate owners? Well, according to Dan McNamara, founder of Polpo Capital Management, we're just seeing the beginning. He shared with Bloomberg that approximately $35B in CMBS office loans are due to mature this year. Even established players like Brookfield have started to lag in their mortgage payments for large office spaces.

However, it's not all bad news. Current data indicates that existing debt that brings together a variety of commercial real estate loans is generating yields over 5.5% in secondary markets. This is one of the highest levels seen in over a decade.

At this point, you may be asking, "What's the solution?" One potential answer lies in tokenization. By using blockchain technology, real estate owners can tokenize their assets, breaking them down into smaller, more manageable units. This allows for increased liquidity, ease of transfer, and the potential for fractional ownership, opening up opportunities for new investors and diversified investment portfolios. As we navigate these challenging times, tokenization may provide a path forward that creates value and resilience in our real estate portfolios.

🔓2. The Surge in Real-World Asset Tokenization and What It Means for You

Significance: As someone who has always been a firm believer in the potential of DeFi, I have to say that the rise of real-world asset (RWA) protocols is not only surprising but exhilarating. These protocols allow entities to tokenize and trade real-world assets, and the recent surge in their usage and value is a testament to the expanding boundaries of DeFi, its growing acceptance among institutions, and the untapped opportunities that lie in the tokenization of assets

⚡INVESTMENT OPPORTUNITIES ⚡

🥂3. Dive into the Digital Age: Uncover Shipwreck Treasures with the Treasure Experience 2

The investment is in the Treasure Experience 2™, a groundbreaking venture that combines shipwreck exploration with cutting-edge digital technologies, including a Security Token Offering (STO) called "TRZX" and a unique treasure hunting game in the Metaverse1. This venture is exciting because it offers a one-of-a-kind immersive experience for token holders who can virtually join the divers in real-time, receive recovered items in real life, r and gain exclusive access to unique digital artifacts and collectibles, offering an unprecedented level of engagement and interaction with the captivating world of shipwreck exploration

💰4. Investing in a Digital Gold Rush: Dignity Gold Unveils Blockchain-Backed Token

The Dignity Gold token, or DIGau, is a novel fusion of physical assets and digital technology, leveraging blockchain to provide a stable, gold-backed token for investment in the US precious metals mining and mineral sectors. This intriguing investment could offer a winning combination to our high-net-worth audience, as it uniquely marries the timeless intrinsic value of gold with the fluidity and security of a digitally transferable asset, all while opening doors to a historically rich industry.

Official website: https://Dignitygold.com

Twitter address: https://twitter.com/DIG_Au

🏫 TOKENIZATION EDUCATION 🏫

🎨5. NFTs Spearheading a Global Economy Makeover

It’s interesting to watch the stunning ascendancy of non-fungible tokens (NFTs) as they reshape the contours of value and ownership, projecting a market worth that could exceed $200 billion. NFTs are set to revolutionize various sectors, from art, real estate, to sports and beyond, empowering creators, enhancing security, and broadening the spectrum of investment opportunities for NFTs backed by assets investors. (READ)

👔6. Ravencoin's Pioneering Approach to Asset Tokenization

As a passionate connoisseur of digital asset advancements, I find Ravencoin's strides in asset tokenization and secure messaging to be an intriguing development. This unique open-source project, specifically designed for the tokenization of assets and secure messaging, brings a new level of flexibility and security to the asset owners' table, allowing them to seamlessly tokenize, transfer, and manage their assets with utmost transparency and control (READ)

🦄 EXPERT TOKENIZATION INTERVIEWS 🦄

🧭7. Evasion or Innovation? Ava Labs CEO Defends Tokenization in Front of U.S. Policymakers

- Ava Labs CEO Emin Gün Sirer

This Is a pivotal moment in the dialogue between the tech and regulatory worlds, as Ava Labs CEO Emin Gün Sirer prepares to address U.S. policymakers, emphasizing that tokenization is not an effort to evade laws but a natural product of blockchain technology. Sirer's testimony is poised to impact how regulations might shape the future of blockchain technologies, and this serves as a stark reminder for our esteemed asset owners that we are truly living through an era of monumental digital transformation. (READ HIS TESTIMONY)

🚀 COMMUNITY SPOTLIGHT 🚀

🏗8. A Revolutionary Move: Israel Pioneers in Issuing the World's First Digital Government Bond

This game-changing development for capital markets, as Israel's Project Eden, a collaboration between the Tel Aviv Stock Exchange (TASE) and Israel's Finance Ministry, successfully completes the proof-of-concept phase for a digital Israeli Bond traded on a blockchain platform. Institutional investors and venture capitalists should take note of this breakthrough as it showcases the power of blockchain technology and tokenization in revolutionizing the financial market, promising to improve efficiency, reduce risks, and create lucrative opportunities.

🤖9. Breaking Barriers: How Digital ADRs Can Democratize Investment Opportunities

This signals a new era for asset tokenization, as INX and The Digital Securities Depositary Corporation (DSDC) announce their strategic partnership to innovate the issuance of fully regulated digital American depositary receipts (ADRs). This move is significant for you, my savvy institutional investors and venture capitalists, as it expands your investment landscape by democratizing access to previously restricted markets and fostering a more inclusive, borderless financial system. (READ)

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.Agency, who has been making waves in the world of crypto and ecommerce for over two decades. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

Follow Mark

Twitter @markfidelman

LinkedIn @fidelman

Instagram @markfidelman