The SWIFT Move Towards Multi-Blockchain Tokenization

Token Insider Volume 50

🔒 NEED TO KNOW 🔒

Listen up, folks! We're at the cusp of a financial revolution, and if you're not paying attention, you're going to be left in the dust. Two seismic shifts are happening: SWIFT is connecting multiple blockchains to streamline tokenized asset management, and the London Stock Exchange is going full-on blockchain + tokenization. This isn't just tech talk; it's the future of how assets will be managed, traded, and tokenized.

This Week’s Bullet Points:

SWIFT's Multi-Blockchain Connection: SWIFT, the global financial messaging network, is working on connecting multiple blockchains to facilitate the transfer of tokenized assets. This is a game-changer for institutional investors who believe that tokenization will revolutionize asset management. Why does it matter? It's all about interoperability and reducing operational challenges. Read more here

London Stock Exchange Embraces Blockchain: The London Stock Exchange isn't just dipping its toes into blockchain; it's diving headfirst. They're planning to launch a blockchain-powered digital markets business by 2024. This isn't a drill; it's a seismic shift in traditional asset trading. Why should you care? Because it's setting the stage for greater efficiency, transparency, and the tokenization of real-world assets. Read more here

Why They Matter

If you're in real estate, equity, or debt markets, these developments are not just news; they're your future playbook. The financial landscape is changing, and these are the early warning signs. Ignore them at your own peril.

⚡INVESTMENT OPPORTUNITIES ⚡

1. Will Trucpal Tokens Take Freight?

Trucpal tokens are security tokens backed by a Chinese road freight company aiming to digitize and streamline the entire logistics industry.

Now, why should you care? Because this isn't just a token; it's a golden ticket into the booming Chinese freight market, offering dividends and a piece of a company that's leveraging blockchain for transparency and efficiency. Trust me, you don't want to miss this ride. Read more here

2. Saddle Up for Profits: The New Frontier of Asset Tokenization in Horse Racing

The investment we're talking about here is in a horse racing syndicate, tokenized by Doug Leonard's Hifi Finance.

Now, why should you care? Because this isn't just betting on horses; it's owning a piece of a professionally managed, cash-flowing, and insured equine empire that's leveraging blockchain for financial maturity in the horse industry. Read more here

3. Tokenizing $10 Billion into Dubai's Future: The Desert Pearl Unveiled

The investment on the table is Dubai's $10 billion Desert Pearl real estate tokenization project, a collaboration between DDX Global and Zhuzh Designs.

This is Big: This isn't just real estate; it's a fusion of luxury, technology, and sustainability, offering you a stake in a resort city complete with hotels, apartments, and even a 40-story pearl-shaped entertainment hub.

🏫 TOKENIZATION EDUCATION 🏫

4. AI Meets Tokenization: The Future of Finance for the Ultra-Rich

Offplan Property Exchange shows that tokenization is making real estate investment more accessible, even for those who don't have millions to throw around. This is a masterclass in financial democratization, teaching us that tokenization can lower the barriers to entry, making it easier for you to diversify your already impressive portfolios.

Then, Nerdbot dives into how AI and tokenization are like the Batman and Robin of the financial world. This is your advanced course in Financial Innovation 101, illustrating that when AI and tokenization team up, they're not just changing the game; they're creating a whole new league for high-value asset owners like yourselves.

🚀 TECHNOLOGY SPOTLIGHT 🚀

We're about to dive into the wild west of finance, where blockchain is the new sheriff in town and tokenization is the gold rush everyone's talking about. From SWIFT playing mad scientist with multiple blockchains to tokenization breaking down the country club doors of traditional finance, check this out folks:

5. SWIFT and Chainlink's Tokenization Experiment:

This isn't just tech jargon; it's the future of asset markets. SWIFT and Chainlink have successfully transferred tokenized value across multiple blockchains. This is a game-changer for financial institutions looking to scale globally.

6. Tokenization Solving Finance's Diversity Problem:

Forget the old boys' club; tokenization is opening the doors to everyone. By breaking down assets into smaller, tokenized units, a broader range of investors can now participate.

🦄 COMMUNITY SPOTLIGHT 🦄

From the U.S. to Germany and South Korea, tokenization is breaking down barriers and creating a global community of investors. 🌍💰

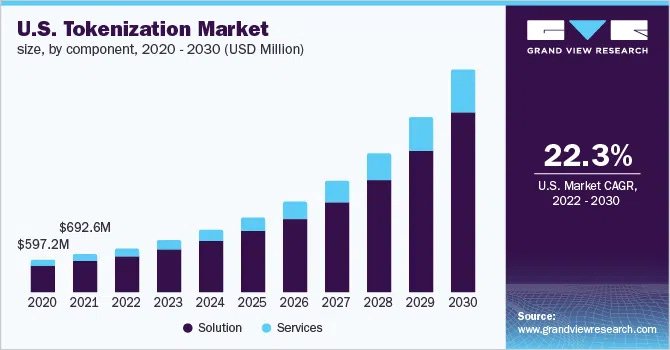

7. The Baltimore Chronicle: Asset Tokenization Platforms Market 2023

Key Takeaway: The article delves into the key players and insights in the asset tokenization market for 2023.

Why It Matters: Understanding the market landscape is crucial for making informed investment decisions. Knowledge is power, folks!

8. The Investor: Experts Explore NFT Applications, STO Market Dynamics

Key Takeaway: The NFT 2023 Seoul Conference highlighted the growth trajectory of Web3 and the role of Security Token Offerings (STOs) in fundraising.

Why It Matters: With a predicted $50 trillion-$60 trillion Web3 valuation by 2030, you'd better believe STOs and NFTs are more than just acronyms—they're your ticket to the future.

9. Ledger Insights: Metzler Issues First German Tokenized Fund Shares

Key Takeaway: Metzler Asset Management has launched the first German tokenized fund shares, compliant with Germany's 'crypto' securities laws.

Why It Matters: This is a game-changer for the German financial market, and it sets a precedent for how tokenized assets can be regulated. If you're not looking at tokenized funds, you're missing out on a revolution.

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.Agency, who has been making waves in the world of crypto and ecommerce for over two decades. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

P.S. Whenever you're ready, there are 4 ways I can help you:

#1: Ready to grow your personal brand to $5 million or more? Let's chat. >>> Click here to apply for your call with me

#2: Have you seen my YouTube Channel? I'm putting a ton of energy into creating heaps of valuable content that I think you'll like. Come check out my latest Tokenization Videos, and give me a like and subscribe.

#3: Promote your brand to over 5500 subscribers by sponsoring this newsletter.

#4: Follow me on Twitter and LinkedIn for more operating systems, marketing tips, and community-building systems.