PayPal Dives into Tokenized DeFi

Mitsubishi UFJ, Rakuten, and Mizuho are pioneering a security tokens offering as well

This week's newsletter dives into the transformative wave of tokenization sweeping across industries, from finance to real estate and beyond. As we explore groundbreaking ventures and technological advancements in how assets are managed, traded, and invested in.

Here's a snapshot of the pivotal movements shaping this dynamic landscape:

Emerging Tokenization Trends This Week:

Cross-Industry Adoption: Tokenization is not confined to one sector but is being explored across various industries, indicating its versatile application and potential to disrupt traditional investment models.

Blockchain as a Foundation for Financial Innovation: The increasing involvement of major financial institutions in blockchain and tokenization projects underscores the technology's potential to revolutionize the financial industry.

Smart Contracts for Enhanced Compliance and Efficiency: The use of smart contracts in tokenization projects points to a future where transactions are not only more secure but also more compliant and efficient.

🔒 NEED TO KNOW 🔒

Japan's Financial Giants Embrace Tokenization: Mitsubishi UFJ, Rakuten, and Mizuho are pioneering a security tokens offering, marking a significant leap in blockchain adoption for financial services in Japan.

Real-World Tokenization Examples: From real estate to fine art, tokenization is democratizing investment opportunities, enhancing liquidity, and ensuring greater accessibility.

Chainlink's Role in Financial Institutions: Leading banks are beginning to tokenize real-world assets, with Chainlink Labs facilitating this shift towards blockchain technology.

Citi's Tokenization Test with Avalanche: Although details are sparse, Citi's exploration into tokenizing private markets using Avalanche highlights the growing interest in blockchain solutions among traditional financial institutions.

Innovative Tokenization of Private Equity Funds: A collaboration between Citi, Wellington Management, WisdomTree, and ABN AMRO is leading the charge in tokenizing private equity funds, showcasing the potential for smart contracts in enhancing efficiency and compliance.

🏙 REAL ESTATE 🏙

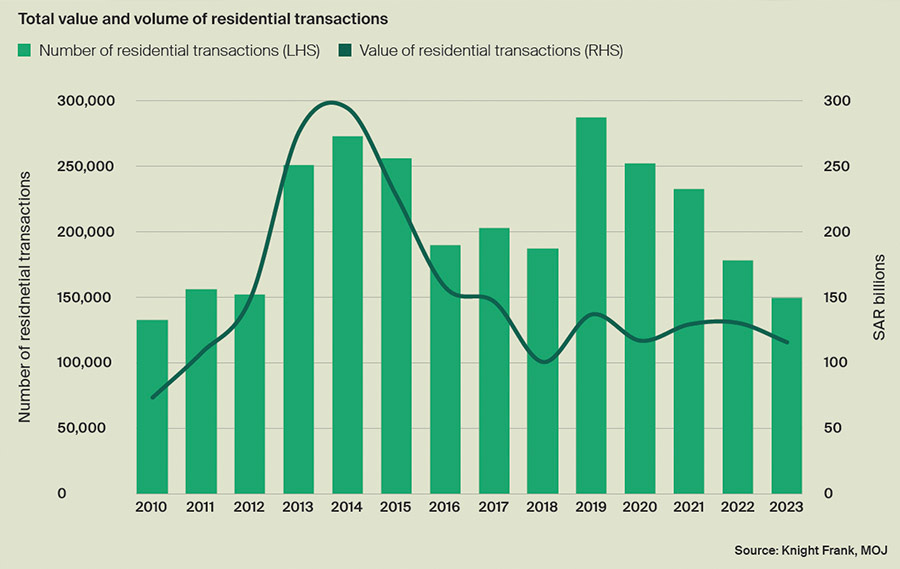

In this week's "Real Estate" section, we delve into the challenges facing Saudi Arabia's housing market, highlighted by a significant slowdown in residential transactions due to rising affordability issues, as reported by global property consultancy Knight Frank.

Knight Frank reports a -17% drop in real estate transactions in Saudi Arabia in 2023, with residential deals falling by -16% due to affordability challenges and higher interest rates.

The Saudi Ministry of Housing introduces 'Dhamanat', a new mortgage guarantee services firm, to improve homeownership accessibility amidst a nationwide price correction.

Commercial Real Estate is Defaulting at an Alarming Rate

🏫 EDUCATION 🏫

RWA Tokenization: A Gateway to the Future of Asset Investment

Understanding RWA Tokenization: Discover how real-world assets (RWAs) like real estate and art are being transformed into digital tokens on the blockchain, offering enhanced accessibility and liquidity.

Actionable Insight: Leverage blockchain technology to tokenize assets, broadening investment opportunities and democratizing access to previously illiquid markets.

Branding in the Web3 Era: Enhancing Customer Loyalty through Tokenization

Tokenization Strategies for Branding Assets: Explore how brands can use tokenization to foster customer loyalty, engagement, and brand allegiance in the Web3 landscape.

Actionable Insight: Implement tokenization strategies to create unique, value-driven experiences for customers, thereby strengthening brand loyalty and engagement in the Web3 era.

EigenLayer's DeFi Value Soars to $7.7 Billion with Restaking Innovation

EigenLayer's total value locked in DeFi protocols surged from $2.03 billion to $7.7 billion in February, thanks to its innovative restaking approach and the temporary removal of its deposit cap.

This explosive growth underscores the increasing appetite for restaking platforms within the DeFi ecosystem, offering both enhanced rewards for ETH stakers and expanded security for new projects. It also highlights the dynamic nature of DeFi markets, where strategic adjustments, like lifting deposit caps, can significantly influence platform popularity and user engagement.

🧭 TECHNOLOGY SPOTLIGHT 🧭

In this week's "Technology Spotlight," we're diving into how blockchain technology is revolutionizing the luxury collectibles market and the world of finance, featuring innovations from Polygon and PayPal that are bridging the gap between digital and traditional assets.

Polygon Empowers Luxury Collectibles with Crypto Liquidity

Polygon-based Lending Platform Transforms Luxury Collectibles into Liquid Assets: Altr, advised by Davide Rovelli, leverages blockchain to offer loans against luxury items, enhancing liquidity and transparency.

Actionable Insight: Utilize blockchain to digitize and tokenize luxury collectibles, enabling quick access to loans and unlocking their economic value.

PayPal's PYUSD Enters the DeFi Arena

PayPal's PYUSD Stablecoin Integrates with DeFi for Future Finance: PayPal's venture into DeFi with PYUSD via Morpho Blue signifies a major leap towards fusing digital currencies with traditional financial mechanisms.

Actionable Insight: Explore the potential of stablecoins like PYUSD in the DeFi space to yield returns on tokenized real-world assets, merging the realms of digital and traditional finance.

Why Cardano's Thriving Ecosystem Is the Future of Blockchain We've Been Waiting For

What do we know?

We've got our hands on some juicy details about Cardano's ecosystem flourishing like never before. It's all about exploring those notable DApps that are not just surviving but thriving, setting the stage for what's shaping up to be an explosive 2024 in the Web3 future.

Why Is It Important?

This isn't just another blockchain story; it's a testament to Cardano's robust, scalable, and sustainable platform. The significance lies in the diverse applications spanning finance, social media, and beyond, proving Cardano's potential to be a heavyweight in the decentralized world.

Why does it matter?

Folks, this matters because it's about more than just technology; it's about real-world utility and adoption. As these DApps gain traction, they're not just promoting Cardano; they're laying down the groundwork for a decentralized future we've all been dreaming about. It's a clear signal that the blockchain space is evolving, and Cardano is at the forefront of this revolution.

🦄 COMMUNITY SPOTLIGHT 🦄

1. CurioInvest Launches Curio Chain to Democratize RWA Tokenization

CurioInvest aims to revolutionize the investment landscape by making real-world asset (RWA) tokenization accessible, enhancing liquidity and bridging fragmented markets.

Actionable Insights:

Embrace blockchain technology to improve investment liquidity.

Leverage DAO governance to give investors a voice in platform decisions.

2. Tassets Evolves into Zoniqx, Redefining Asset Tokenization

Zoniqx emerges with a new identity, aiming to pioneer the future of asset tokenization with its innovative Tokenized Asset Lifecycle Management (TALM) solution.

Actionable Insights:

Explore Zoniqx's platform for diverse asset tokenization.

Utilize SecureConnect to enhance liquidity and digital asset market entry.

3. Zetrix and Web3Labs Unite to Accelerate Web3 Startup Growth

Zetrix and Web3Labs launch a global accelerator program for Web3 startups, fostering innovation and collaboration in the blockchain space.

Actionable Insights:

Participate in the accelerator program to leverage Hong Kong’s VA ecosystem.

Collaborate with government or enterprise stakeholders to deploy innovative applications.

4. Japan Advances Law to Empower VCs in Web3 and Crypto Tokens

Japan progresses law for VCs to invest in web3 crypto tokens, enhancing the country's blockchain and digital asset landscape.

Actionable Insights:

Consider the implications of Japan's legal adjustments for global blockchain investments.

Explore opportunities in RWA tokenization and stablecoin innovation in Japan.

5. Tokenization Initiatives: Unlocking Africa's Economic Potential

Why tokenization initiatives hold the key to Africa’s economic sovereignty, offering a path towards economic and monetary sovereignty.

Actionable Insights:

Leverage tokenization for cross-border trade and investment.

Utilize tokenized bonds and deposit tokens to attract foreign investment and enhance financial inclusivity.

6. Baker McKenzie Advises on Pioneering Cross-Border Digital Bond Pilot

Baker McKenzie advises on world's first cross-border repo and natively-issued digital bond pilot, marking a significant milestone in digital finance.

Actionable Insights:

Explore the potential of blockchain for real-time global digital asset transactions.

Consider the legal and regulatory framework for cross-border tokenization.

7. Iowa Redefines Tokenized RWAs as Personal Property in Digital Asset Bill

Tokenized real world assets (RWA) redefined as personal property in landmark Iowa digital asset bill, integrating digital assets into commercial transactions.

Actionable Insights:

Understand the legal implications of classifying digital assets as personal property.

Monitor the evolution of legal frameworks for digital assets across jurisdictions.

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.XYZ, who is making waves in the world of Tradfi using tokenization as his battering ram. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

P.S. Whenever you're ready, there are 4 ways I can help you:

#1: Ready to tokenize your business, real estate or assets and its $5 million or more? Let's chat. >>> Click here to apply for your call with me

#2: Have you seen my YouTube Channel? I'm putting a ton of energy into creating heaps of valuable content that I think you'll like. Come check out my latest Tokenization Videos, and give me a like and subscribe.

#3: Promote your brand to over 5500 subscribers by sponsoring this newsletter.

#4: Follow me on Twitter and LinkedIn for more operating systems, marketing tips, and community-building systems.