Mastering Tokenization Fundraising

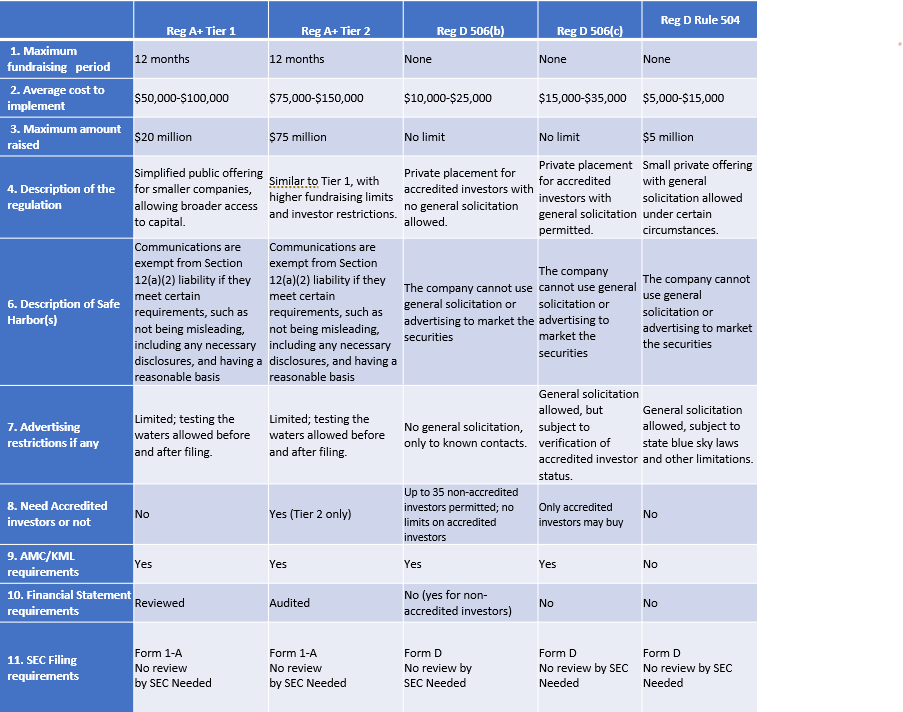

A Comprehensive Comparison Guide to Reg A+, Reg D, and Reg S for Tokenized Businesses

In today's rapidly evolving investment landscape, the rise of security token offerings (STOs) has opened up new avenues for companies looking to tokenize their existing assets or businesses seeking capital. As an expert in this field, I'll be dissecting some of the most popular and effective securities regulations in the United States, including Reg A+, Reg D, and Reg S, and how they lay the foundation for a successful STO.

We'll be exploring the intricacies of these regulations, their advantages, and how they can benefit your company's tokenization and fundraising strategy. So, whether you're a startup seeking early-stage financing through tokenization or an established business looking to tokenize your assets, this article is your go-to guide for navigating the complex world of STOs and fundraising regulations.

Key Differences Between Regulation D Rule 506(b) and Regulation D Rule 506(c) You Need to Know

Information Requirements

There's no distinction between Rule 506(b) and Rule 506(c) when all investors are accredited. However, if a single non-accredited investor is involved in a Rule 506(b) offering, issuers must provide significantly more information.

Advertising Approach

In Rule 506(b) offerings, you're limited to advertising your brand, while Rule 506(c) allows you to promote the actual deal. For 506(b), you can use your website to attract investors who sign up and undergo a know-your-customer process in line with SEC guidelines. This includes having investors fill out questionnaires, engaging in multiple phone conversations, and evaluating their investment experience to establish a relationship. Only then should the issuer present actual investments.

In contrast, websites featuring Rule 506(c) investments can showcase real investment opportunities to all visitors.

Accredited Investor Verification

For Rule 506(b), issuers can rely on investors' statements about their accredited status, unless there's reason to doubt their honesty. Rule 506(c), however, mandates that issuers take reasonable measures to confirm every investor's accredited status. The SEC allows issuers to rely on primary documents like tax returns, brokerage statements, or W-2s, but they can also trust a letter from the investor's lawyer, accountant, or broker. I typically advise clients against handling the verification process themselves; instead, I recommend obtaining a certification letter from the investor's lawyer, accountant, or broker, or using third-party services like VerifyInvestor."

What about a Regulation S Offering?

Regulation S (Reg S) is a Securities and Exchange Commission (SEC) regulation that provides a safe harbor for companies issuing securities outside the United States. Reg S allows U.S. and non-U.S. issuers to raise capital from non-U.S. investors without having to register the offering with the SEC. This can be advantageous for companies seeking to tap into foreign investment markets, as it simplifies the fundraising process and reduces the costs and regulatory burdens associated with SEC registration. Reg S offerings can be conducted simultaneously with other offerings, such as Regulation D offerings, enabling issuers to target both U.S. and non-U.S. investors.

Please note that while Reg S provides certain benefits, it is essential for issuers to comply with the securities laws and regulations in the jurisdictions where the offering is made.

In conclusion, understanding the nuances of Reg A+, Reg D, and Reg S is crucial for businesses looking to capitalize on the opportunities presented by security token offerings. By carefully considering the regulatory landscape and selecting the most appropriate fundraising path, you can position your tokenized assets or business to thrive in this exciting new market. Keep in mind that while these regulations offer several benefits, it's always essential to consult with legal and financial experts to ensure full compliance. As the world of STOs continues to evolve, staying informed and adaptable will be key to unlocking the full potential of tokenized fundraising for your company's growth and success.