Investor Alert: Are Family Offices Cooling Off on Future Crypto Investments?

Monday's Minted Moments

🧞Ripple Acquires Metaco in Strategic $250M Deal, Advancing in the $10 Trillion Future of Tokenization

Ripple has acquired the Swiss digital asset custody company Metaco for $250 million, making Ripple the sole shareholder. Metaco, which will continue operating as an independent brand, offers tokenization tools and custody infrastructure that have been used by large financial institutions like Citi, Union Bank, and Bank BNP Paribas12.

This acquisition allows Ripple to expand its institutional offerings, including the technology to custody, issue, and settle any type of tokenized asset, thereby increasing its potential revenue streams. Metaco anticipates growth acceleration due to Ripple's extensive customer base and resources

Despite the ongoing crypto winter, Ripple maintains a long-term strategy focused on institutional adoption of crypto assets, with predictions that assets under custody may reach or surpass $10 trillion by 2030. This mirrors sentiments from industry leaders like the CEO of BlackRock and Citi bank's future of finance lead, who highlight the increasing importance of tokenization in the financial sector

Our Take ➞ This acquisition signifies a major strategic move by Ripple, positioning the company at the forefront of the tokenization trend that is anticipated to dominate the next generation of financial markets. With Metaco's technology, Ripple can offer more comprehensive services to its customers, potentially leading to an increased market share. This could also set a precedent for other crypto companies to follow suit in expanding their services. Moreover, the emphasis on tokenization by industry giants such as BlackRock and Citi bank indicates a growing recognition of blockchain technology's potential, which could lead to increased institutional adoption and growth of the crypto market.

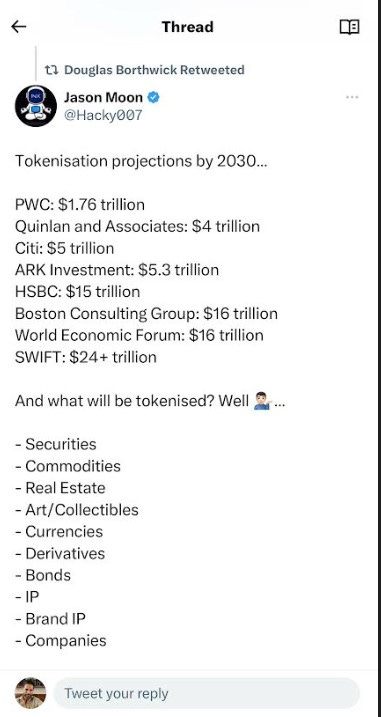

🔮 Full List Of Tokenization Predictions

PWC, Citi, Boston Consulting have all weighed in:

⚾ SEC Plays Hardball with Coinbase: Regulatory Clarity? No Thanks

Coinbase's request to the SEC in the summer of 2022 for regulatory clarity on digital assets was met with indifference, as the SEC did not feel obligated to provide such rules. This led to a legal tussle, with the SEC issuing a Wells notice to Coinbase for allegedly violating securities laws in March.

Despite Coinbase's subsequent lawsuit demanding a public response to their 2022 petition, the SEC stood its ground, stating that it is under no obligation to provide regulatory clarity, especially within Coinbase's desired timeframe.

Our Take ➞ Folks, we are witnessing a classic power play in the crypto regulatory space. The SEC's lack of response to Coinbase's request for regulatory clarity signals the underlying challenge in the crypto industry: the struggle for clear-cut regulations. It's akin to an intense chess game, where one side is pressing for rules while the other remains noncommittal. This standoff not only affects Coinbase but the entire crypto industry, as it creates uncertainty and potential hurdles for innovation. It's a fascinating tug-of-war that could shape the future of cryptocurrency regulation.

💵 $100 Billion

A new report by the Global Financial Markets Association (GFMA) estimates that the traditional finance (TRADEFI) sector could save over $100 billion annually by implementing distributed ledger technology (DLT), including potential savings of an additional $100 billion from streamlining collateral processes in derivatives and lending markets, and $20 billion from automating clearing and settlements with smart contracts1.

👔 Family Offices Show Faith in Blockchain Despite Waning Interest in Future Crypto Investments: Goldman Sachs Report

According to a report by Goldman Sachs, 32% of family offices currently hold investments in digital assets, including cryptocurrencies, NFTs, DeFi, and blockchain-focused funds. The report shows that while interest in digital finance rose from 16% in 2021 to 26% in 2023, the interest in future investments in crypto has dropped from 45% to 12% in the same period.

The report, which is based on a survey conducted with 166 home offices, shows that a belief in the power of blockchain technology is the primary motivation for these investments, with 19% citing this reason, compared to 8% and 9% for speculation and portfolio diversification, respectively3

Our Take ➞ In my opinion, this data underscores the volatility and uncertainty that still surrounds the crypto market. Which is why we moved to the security token markets. While there's a significant number of family offices investing in digital assets, it's interesting to see that faith in blockchain technology drives these investments more than speculation or diversification. This suggests that despite short-term fluctuations in interest, the long-term outlook for blockchain and related technologies remains positive among these investors. The decline in interest in future investments, however, could reflect concerns about regulatory uncertainties or market volatility.

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.Agency, who has been making waves in the world of crypto and ecommerce for over two decades. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

But that's not all - Mark has also been recognized as a top influencer by Forbes Magazine, named a social media keynote speaker by Inc Magazine, and ranked among the Huffington Post's Top 50 Most Social CEOs. He's even got his own YouTube channel, Cryptonized!, where he shares insights on the hottest crypto trends.

As a globally recognized thought leader on cryptocurrency and ecommerce, Mark has written for Forbes and interviewed hundreds of CXOs from Global 3000 companies. His expertise and experience make him a sought-after speaker and writer, and you can keep up with his latest insights by following him on Twitter at http://twitter.com/#!/markfidelman