How Tokenized Real Estate Is Reshaping Capital Flows, Are You Ready?

The Dawn of Real Estate Tokenization: Why the Industry Is at a Tipping Point

From Tradition to Transformation

What if buying a share of a skyscraper was as easy as buying a stock? For decades, real estate has meant stability and long-term value, but it’s also been out of reach for most, locked behind high capital requirements, complex paperwork, and a maze of middlemen. If you’re a developer, accredited investor, or institutional player, you know how much friction and inefficiency slows down capital raising and deal flow.

Now, the landscape is changing, fast. The global real estate market is valued at over $6 trillion, yet only a small fraction is accessible to the average investor. The real untapped potential lies in making real estate assets liquid, divisible, and accessible, regardless of where you live or how much you have to invest. And that’s precisely what tokenization is aiming to achieve.

What’s Fueling the Shift Now?

Tokenized real estate is transforming capital flows and unlocking liquidity for investors worldwide. According to market forecasts, the $1.5 trillion global tokenized real estate market could be reality by 2025, up from just $20 billion today. That’s exponential growth, powered by blockchain, AI, a new wave of digital-native investors, and regulatory frameworks that are finally catching up to technology.

Sergey Nazarov of Chainlink summed it up: “Asset tokenization is set to accelerate the movement of capital across traditional markets... We want more assets onchain.” Institutions and platforms like SmartBlocks are racing to unlock what could be an $812.5 billion serviceable market. Imagine if anyone could participate in global real estate, whether you’re in Dubai or Miami, with $50 or $5 million.

Of course, the journey isn’t without hurdles. Regulatory questions and technological learning curves remain. But the direction is clear: real estate is finally moving toward the liquidity, accessibility, and efficiency the digital world demands. And the opportunities for early movers are enormous.

SmartBlocks Presents: May 21, 2025 at 10am Webinar!

Check out our free webinar TODAY on one of our best deals on the platform

Breaking Barriers: How Real Estate Tokenization Unlocks Liquidity and Accessibility

The Mechanics of Tokenized Real Estate

Let’s break it down. Real estate tokenization uses blockchain technology to convert property ownership into digital tokens. Each token is a cryptographically secure slice of the underlying asset, managed by smart contracts that automate compliance, distribution, and transfer. In other words, you can buy, sell, or trade fractional shares of a building just like you’d trade stocks or crypto online.

Blockchain ensures transparent and secure transactions.

Smart contracts automate payouts, compliance checks, and transfers.

Tokens represent equity, debt, or even cash flows from properties.

For investors, that means less bureaucracy, fewer delays, and far lower entry barriers.

Fractional Ownership and Democratized Access

You don’t have to take our word for it, platforms like SmartBlocks are already making this possible. If I’d had access to fractional property tokens ten years ago, my investment portfolio would look very different today. With tokenization, the minimum investment can drop as low as $50. That’s not a theory, it’s happening right now on SmartBlocks and similar platforms, opening the door for millennials, global investors, and anyone who’s been shut out of traditional real estate.

Fractional ownership breaks the six-figure barrier of traditional real estate investing.

Tokenized equity and debt let both retail and institutional investors diversify with ease.

Global reach, no more being limited by local markets or currencies.

Would you invest in a prime Dubai property if you could do it in minutes from your phone? That’s how accessible tokenized real estate investing is becoming.

Liquidity Through Secondary Markets

Historically, liquidity has been the Achilles’ heel of real estate. But now, secondary markets for property tokens, think tZERO, or SmartBlocks’ own exchange, make it possible to enter and exit positions with unprecedented speed. Year-over-year trading volume in tokenized real estate is demonstrating real liquidity gains previously unimaginable in this sector.

Myth vs. Reality:

Myth: Tokenized real estate is just as illiquid as traditional property.

Reality: Secondary markets are providing real, measurable liquidity, but adoption and trading volumes still vary by project and platform.

Tokenization isn’t a magic wand. Some projects may still see limited trading, especially early on. But it’s the most significant leap toward true liquidity and accessibility that real estate has ever seen.

Mini Case Study:

Last month, a SmartBlocks user in Singapore invested in a Miami multifamily property in just a few clicks, no flights, no paperwork marathons. The flexibility to diversify across continents, with minimal capital, is no longer a future promise, it's today's reality.

Accelerating Capital Flows: The New Era of Tokenized Real Estate Investment

Institutional and Retail Momentum

Tokenization doesn’t just open doors for individuals, it attracts a much broader investor base. From global institutions to family offices, the opportunity to diversify portfolios and access new markets is irresistible. This flood of new capital is driving faster project velocity and more efficient fundraising, as tokenized real estate expands its reach and impact. For developers, that means capital-raising cycles can shrink from months to weeks, or even days.

New capital sources from both accredited and retail investors

Faster, more efficient fundraising for real estate projects

Broader diversification opportunities for everyone

AI and DeFi: Turbocharging Tokenized Real Estate Investing

Let’s be honest: real estate investing has always favored those with deep pockets and insider access. Now, AI and DeFi are leveling the playing field. Platforms like SmartBlocks harness AI to offer personalized investment recommendations and automate due diligence, making sophisticated strategies accessible to all. Whether you’re a developer or investor, predictive analytics and tailored insights are delivered right to your dashboard.

And DeFi (decentralized finance) is rewriting the rules of lending and borrowing. Imagine using your property tokens as collateral to unlock instant capital for your next project, no banks, no waiting. SmartBlocks’ DeFi lending and borrowing marketplace, paired with AI-powered underwriting, dramatically shortens approval times and empowers users to move at digital speed.

AI-driven investment recommendations for smarter decision-making

On-chain monitoring of property values and cash flows

DeFi lending lets you collateralize property tokens for immediate liquidity

Real-World Impact: From Developers to Investors

Picture this: a developer raises capital for a new project in days, not months, and an investor refinances their property tokens in real time, no piles of paperwork, no endless intermediaries. That’s not just efficiency; it’s empowerment. You no longer have to wait years for returns. The combination of AI, DeFi, and secondary markets is fundamentally changing how capital flows through real estate, unlocking opportunities previously reserved for the privileged few.

Of course, with new tech, there’s always a learning curve, but we’re here to help. Trust in algorithms and smart contracts is essential, and due diligence remains critical. Still, the ability to move capital with this speed and transparency marks a new era, one that’s inclusive, efficient, and global.

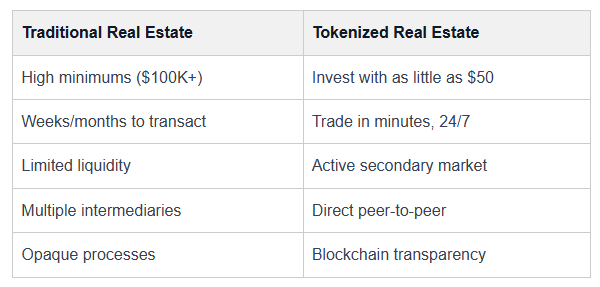

Traditional Real EstateTokenized Real EstateHigh minimums ($100K+)Invest with as little as $50Weeks/months to transactTrade in minutes, 24/7Limited liquidityActive secondary marketMultiple intermediariesDirect peer-to-peerOpaque processesBlockchain transparency

Navigating the Challenges: Regulation, Security, and the Road Ahead for Blockchain Real Estate

Regulatory Evolution and Compliance

Let’s get real. Regulation is the bedrock of trust and long-term growth. Regulatory bodies are refining frameworks to support digital assets, with the US and other regions moving forward in 2025. For platforms like SmartBlocks, compliance with KYC/AML and security token standards is baked into the process, not tacked on as an afterthought. Positive regulatory momentum is driving institutional adoption and helping the industry mature.

Full KYC/AML compliance from onboarding to trading

Security token standards ensure investor protections

On-chain auditability for transparent reporting

Security, Transparency, and Trust

As an early adopter, I’ve seen how essential robust security and transparency are. Blockchain ensures every transaction is recorded immutably, drastically reducing fraud and errors. For you, that means peace of mind. For the industry, it’s a foundation for sustainable growth. At SmartBlocks, we take security and compliance seriously, you can see it in every line of code and every process we implement.

The Path to Mainstream Adoption

But let’s not sugarcoat it: this market is still young. Adoption is growing, but education and ongoing innovation are key. The strengths of tokenization, open access, rapid settlement, programmable compliance, also demand new skills and mindsets from investors and issuers alike. And while regulation can seem like a hurdle, it’s the foundation that separates lasting platforms from short-lived hype.

Q: What keeps you up at night when considering new investment platforms, security or regulation?

Both matter, but in my experience, platforms that prioritize transparent compliance and security standards are the ones that build lasting trust and attract serious capital.

Here’s a pro tip: Look for platforms that not only tout tech, but also lead in regulatory transparency and security protocols. That’s where the real long-term opportunity lies.

5 Things to Know Before Investing in Tokenized Real Estate:

Check regulatory compliance (KYC/AML, licensing).

Understand the liquidity of the specific token/project.

Review platform security protocols and transparency.

Ask about secondary market availability and trading volume.

Educate yourself, don’t invest in what you don’t understand.

The SmartBlocks Perspective: Pioneering the Future of Real Estate Finance

Our Mission in Action

At SmartBlocks, we’re not just building a platform, we’re building a movement toward accessible, liquid, and democratized real estate investing. We believe anyone should be able to invest in prime real estate, no matter where they live or how much they have to start with. Our mission? To break down historic barriers, capital, complexity, and geography, and make real estate an asset class anyone can access, trade, and leverage.

Our pre-registered base of 3,500 investors and $35 million in ready-to-tokenize projects show that the appetite for this transformation is real. By combining blockchain, AI, and DeFi, we deliver a seamless, compliant, and user-friendly experience for both developers and investors. And we’re just getting started.

What’s Next for Tokenized Real Estate?

The future we see is global, inclusive, and liquid. Imagine investing in high-growth regions like the UAE or the US from anywhere in the world, or using property tokens as collateral for new financial strategies. Our vision is a world where the “stock exchange for real estate” is open to all, powered by AI-driven analytics, DeFi lending, and smart contract automation.

But we know real change takes more than just technology. Meaningful impact requires collaboration between platforms, investors, developers, and regulators. We’re committed to ongoing innovation, with you at the center of this new era. Are you ready to be part of it?

Ready to unlock the future of liquid, accessible real estate investing? Schedule a meeting with our team to discover how SmartBlocks can help you participate in the tokenization revolution, whether you’re an investor, developer, or industry innovator.

FAQ

How do I invest in tokenized real estate assets with SmartBlocks?

Investing is simple: sign up, complete KYC/AML verification, and browse available tokenized properties. With a minimum as low as $50, you can purchase fractional ownership in real estate assets worldwide, directly on the SmartBlocks platform.

What is real estate tokenization and how does it work?

Real estate tokenization is the process of converting ownership of a property into digital tokens on a blockchain. Each token represents a fractional share of the asset, enabling secure, transparent, and efficient trading or investment with lower minimums. That means more people, like you, can get involved, whether you’re investing or building.

How does SmartBlocks ensure compliance and security for investors?

SmartBlocks integrates regulatory compliance (KYC/AML) and uses established security token standards. All transactions are recorded on an immutable blockchain ledger, providing transparency and reducing the risk of fraud. Learn more

What are the benefits of investing in tokenized real estate compared to traditional methods?

Tokenized real estate offers increased liquidity, lower investment minimums, 24/7 trading through secondary markets, and enhanced transparency. Investors can diversify more easily and access global markets previously out of reach.

Can I use property tokens as collateral for loans?

Yes. SmartBlocks enables DeFi lending and borrowing, allowing users to collateralize property tokens to access funds for new projects or personal needs, streamlining the real estate finance process.

Is real estate tokenization suitable for both small investors and large institutions?

Absolutely. Tokenization democratizes access, making it suitable for individuals investing as little as $50, as well as institutions seeking efficient exposure to high-value properties and diversified portfolios.

What is the best platform for fractional property ownership?

While several platforms exist, SmartBlocks.xyz is designed as the “Coinbase of Real Estate,” combining a user-friendly interface with global compliance, liquidity, and AI-powered insights for both investors and developers.

How does AI underwriting work in real estate tokenization?

AI underwriting on SmartBlocks analyzes property data, risk factors, and market trends to automate lending decisions. This enables faster, more accurate loan approvals and personalized investment recommendations, helping users make smarter, data-driven choices.