Fortune 500 Companies Embrace Tokenization: 35% Planning Projects

Avalanche Powers Spain's First On-Chain RWA Transaction with Securitize

🔒 NEED TO KNOW 🔒

1. 35% of Fortune 500 Executives Are Planning Tokenization Projects

📊 According to Coinbase's Q2 State of Crypto report, 35% of Fortune 500 companies are planning tokenization projects, with 86% recognizing its potential benefits. Executives are particularly interested in stablecoins for instant settlement, lower fees, and international transfers, as well as tokenizing other financial assets for improved transparency and operational efficiency. See the report

2. Polygon's Vision for the Future of Finance through Tokenization

🔮 Polygon's Butler envisions a future where finance is revolutionized through tokenization, driving efficiency and transparency in financial transactions. Tokenization of assets is set to transform traditional finance systems by enabling real-time settlement and reduced transaction times, as well as improving transparency and traceability of assets. Explore Polygon's vision

3. Tokenization Expands to Life Insurance with Infineo

🛡️ Infineo has minted $9 million of life insurance policies on the Provenance Blockchain, showcasing the expanding scope of tokenization into new sectors. This initiative highlights the potential of blockchain to bring efficiency and transparency to life insurance, setting a precedent for further innovations in the insurance industry. Discover more

💰 DEALS 💰

4. Ondo Finance and Drift Labs Forge DeFi Partnership

What happened? Ondo Finance and Drift Labs have announced a groundbreaking partnership to integrate Real-World Assets (RWAs) into Solana's DeFi ecosystem, allowing Ondo Finance's yield-bearing token, $USDY, to be used as collateral on Drift's perpetuals platform.

Why is it important? This marks the first time yield-bearing tokens can be used as collateral on a perpetuals platform, enhancing capital efficiency and providing more utility to tokenized real-world assets. The collaboration brings significant advancements to the DeFi space, making it more accessible and efficient for traders

5. Ripple and Archax's Bold Move into Tokenization

What happened? Ripple has partnered with Archax to introduce tokenized real-world assets to the XRP Ledger.

Why is it important? This collaboration enhances the potential of the XRP Ledger, offering a streamlined and secure method to tokenize and trade real-world assets. It bridges the gap between traditional finance and blockchain technology, setting the stage for a more integrated financial ecosystem.

📈INVESTMENT OPPORTUNITIES 📈

6. Top 6 Best RWA Tokens in the Market for 2024

Introduction: The article highlights six standout RWA tokens that are set to make waves in the market this year. Each token offers unique advantages, from improved liquidity to enhanced security and transparency.

Investment Insight: Investing in RWA tokens can diversify your portfolio and provide exposure to traditionally illiquid assets. However, it's crucial to research each token's underlying assets and market potential to make an informed decision. Discover the top tokens

7. RWA Narrative Booms: Investors Buying This RWA Hand Over Fist

📈 Why Investors Are Flocking to This RWA

Introduction: The RWA narrative is gaining momentum, with one particular RWA token seeing a surge in investor interest. This token stands out due to its robust backing and promising market performance.

Investment Insight: The strong investor interest suggests confidence in the token's underlying assets and potential for growth. However, as with all investments, it's essential to consider market volatility and conduct thorough due diligence. Learn why investors are interested

🦄 COMMUNITY SPOTLIGHT 🦄

Paxos Layoffs Amidst Strategic Shift

🔄 Paxos Cuts 65 Employees in Strategic Restructuring

Summary: Paxos, known for its work with stablecoins and tokenization, has laid off 65 employees as part of a strategic shift towards settlement services. This move comes as the company aims to refocus its resources and streamline operations. Read more

🏦 Avalanche Powers Spain's First On-Chain RWA Transaction with Securitize

Summary: Avalanche has enabled Securitize to execute Spain's first on-chain Real-World Asset (RWA) transaction in a regulated market, marking a significant milestone for blockchain integration in traditional finance. This transaction represents a major step forward for the adoption of blockchain in regulated markets. Learn more

🔗 RealToken DAO Uses Chainlink for Seamless Cross-Chain Transfers

Summary: RealToken DAO has integrated Chainlink's Cross-Chain Interoperability Protocol (CCIP) to facilitate smooth cross-chain token transfers, enhancing the flexibility and efficiency of tokenized real estate investments. This integration aims to improve asset liquidity and investor accessibility. Discover more

📊 Deloitte Highlights Revolutionary Digitalization of Financial Assets

Summary: Deloitte's latest blog emphasizes the revolutionary impact of digitalizing financial assets, forecasting significant changes in investment management and asset operations. This shift is expected to enhance efficiency, transparency, and accessibility in the financial industry. Read the blog

🏞️ REMD Announces Highlands Resort Tokenization

Summary: REMD has announced the tokenization of Highlands Resort on the Rull Estate Platform, offering investors a new way to invest in real estate through blockchain technology. This initiative highlights the growing trend of using tokenization to democratize real estate investment. Learn more

💼 Fidelity International Embraces Tokenization

Summary: Fidelity International is making a significant move towards tokenization, signaling its commitment to integrating blockchain technology into its investment strategies. This move is expected to enhance asset management and provide more innovative investment solutions. Read more

⚖ LEGAL AND REGULATORY ⚖

🚨 Key Regulatory Insights on Tokenization

What do we know?

A commissioner from the U.S. Securities and Exchange Commission (SEC) has made comments regarding the regulatory framework and future oversight of tokenization, particularly in the context of real-world assets (RWAs).

Why is it important?

These comments signal a potential shift in how the SEC might approach tokenization and the integration of blockchain technology in traditional financial markets. Understanding this perspective is crucial for companies and investors involved in tokenized assets, as it provides insight into future compliance and regulatory expectations.

Why does it matter?

Regulatory clarity is essential for the growth and adoption of tokenization. With the SEC potentially taking a more defined stance, companies can better navigate the legal landscape, ensuring they are compliant while leveraging the benefits of blockchain technology. This could lead to increased trust and participation in tokenized markets.

Read more here: Commissioner Comments on Tokenization

Tweet of the Day:

🔍 Comparing Tokenized Securities to Traditional Listings

What do we know?

A recent article from Securities.io examines the costs and effectiveness of tokenizing securities versus using traditional listing methods, highlighting both the potential benefits and challenges of each approach.

Why is it important?

Tokenizing securities can offer significant advantages, such as increased liquidity, lower costs, and broader accessibility for investors. However, it also presents challenges, including regulatory hurdles and technological complexities. Understanding these factors is crucial for making informed decisions about how to list and manage securities.

Why does it matter?

The comparison between tokenized and traditional securities listings matters because it influences how companies approach fundraising and how investors access markets. As tokenization continues to grow, weighing its costs and benefits against traditional methods will be essential for determining the most effective strategies for capital raising and investment.

Read more here: Tokenizing Securities: Weighing the Costs and Effectiveness Against Traditional Listing

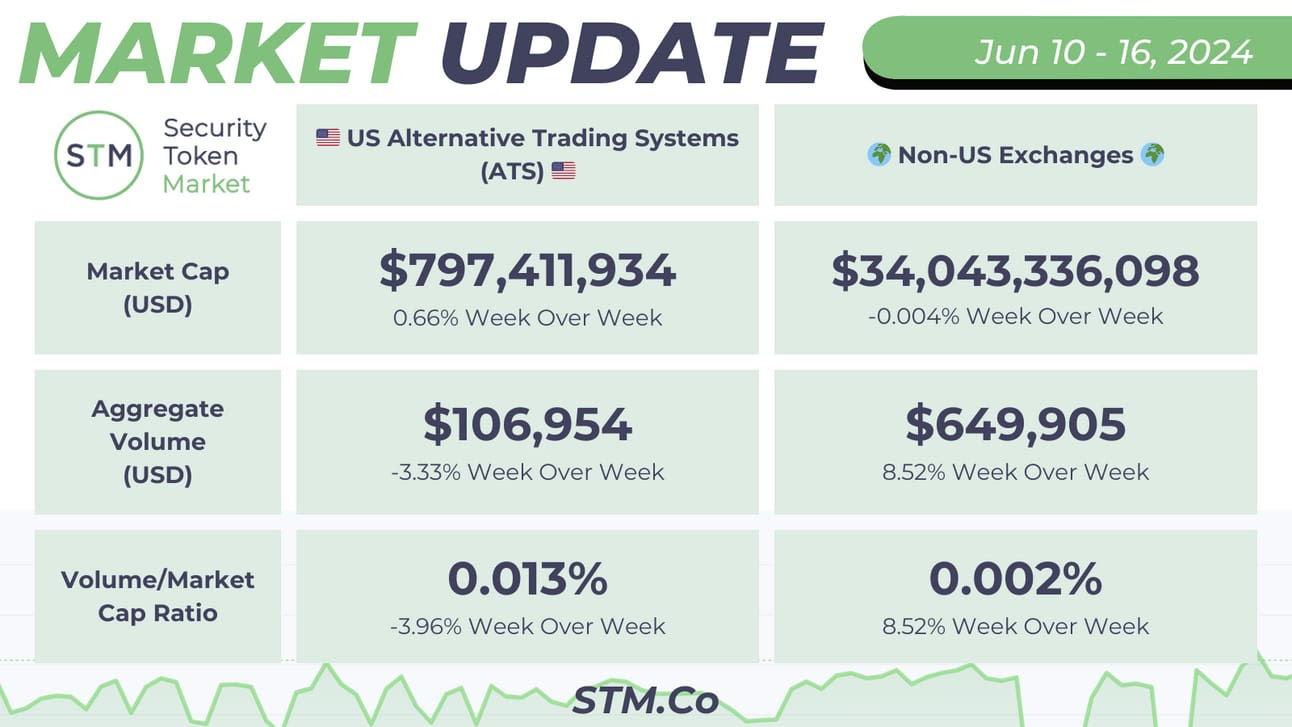

💡 STATS 💡

Let's take a closer look at the compelling statistics from the latest analysis on the top Real-World Assets (RWA) tokens to watch in the current bull market.

📊 $5.2 billion: The total market cap of the top RWA tokens. Source

📈 300% growth: The increase in market cap of RWA tokens over the past year. Source

🔗 80% of RWA tokens are based on the Ethereum blockchain, leveraging its robust ecosystem and security. Source

🏦 45% of institutional investors are planning to increase their exposure to RWA tokens within the next year. Source

🌐 70% of surveyed investors believe RWA tokens will outperform other digital assets in the next bull market cycle. Source

💼 $1 billion: The projected investment in RWA token infrastructure by blockchain companies in the next two years. Source

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.XYZ, who is making waves in the world of Tradfi using tokenization as his battering ram. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

P.S. Whenever you're ready, there are 4 ways I can help you:

#1: Ready to tokenize your business, real estate or assets and its $5 million or more? Let's chat. >>> Click here to apply for your call with me

#2: Have you seen my YouTube Channel? I'm putting a ton of energy into creating heaps of valuable content that I think you'll like. Come check out my latest Tokenization Videos, and give me a like and subscribe.

#3: Promote your brand to over 5500 subscribers by sponsoring this newsletter.

#4: Follow me on Twitter and LinkedIn for more operating systems, marketing tips, and community-building systems.