Congress to Discuss Real-World Asset Tokenization this Week

🔒 NEED TO KNOW 🔒

Here are the must-know highlights:

🌐 How Blockchain Tokenization is Changing Asset Management

Blockchain technology is revolutionizing asset management by enhancing liquidity and providing greater transparency. Dive into the details of this transformative technology and its implications here.

🔮 The Inevitable Future of the Global Financial System is Tokenization

Tokenization is becoming an essential pillar of the global financial system, bringing about a future where assets are more accessible and transactions more efficient. Learn why this shift is inevitable here.

🏢 SteelWave's $500M CRE Fund Offers Tokenized Stakes

SteelWave's latest $500 million commercial real estate fund now includes tokenized stakes, enabling fractional ownership and increased investment opportunities. Get the full scoop here.

📅 Congress to Discuss Real-World Asset Tokenization in June

In June, Congress will be addressing the critical topic of real-world asset tokenization, marking a significant step towards regulatory clarity. Stay updated on this important discussion here.

🏦 Franklin Templeton’s Jenny Johnson on Bitcoin ETFs, RWA Tokenization, and Blockchain’s Potential for TradFi

Jenny Johnson of Franklin Templeton discusses the intersection of Bitcoin ETFs, RWA tokenization, and how blockchain is poised to transform traditional finance. Get her insights here.

🏦 TradFi Rushes In: Goldman Sachs Digital Assets Lead Matthew McDermott on the Institutional Embrace of Tokenization

Goldman Sachs and other major institutions are increasingly embracing tokenization, highlighting a significant trend in traditional finance. Read about this institutional shift here.

📈INVESTMENT OPPORTUNITIES 📈

Mantra Launches RWA Savings Vault Powered by Ondo’s USDY

Investment Overview: Mantra has unveiled a RWA Savings Vault that leverages Ondo’s USDY stablecoin to offer secure and yield-generating investment opportunities.

Why Invest or Not: This vault is designed to provide steady returns with the backing of real-world assets, making it an appealing option for risk-averse investors. However, the reliance on stablecoins means the investment is tied to the stability and regulatory landscape of the cryptocurrency market, which can be unpredictable.

Dive deeper into this opportunity here.

🏫 EDUCATION 🏫

How RWAs Can Stabilize DeFi

Insight: Real-world assets (RWAs) can bring stability to DeFi by providing a tangible backing to digital assets, reducing volatility.

Actionable Takeaway: Integrating RWAs into your DeFi portfolio could enhance stability and mitigate risks associated with the high volatility of purely digital assets.

Explore the full article here.

Show Up, Don’t Show Off: The Real Value in Real Estate

🌟 What happened?

A recent article emphasizes the importance of consistent presence over flashy appearances in the real estate market, highlighting how reliability builds long-term trust and credibility among clients and investors.

🌟 Why is it important?

Tokenization in real estate can significantly benefit from this principle, as consistent and transparent operations in tokenized assets attract more investors by building trust and ensuring steady growth.

🌟 Why does it matter?

For those involved in tokenizing real estate, focusing on dependable and consistent engagement with stakeholders can enhance the credibility of tokenized assets, making them more attractive and stable investments in the long run.

Learn more about the importance of consistency in real estate here.

💰 DEALS 💰

Y Combinator-Backed Talent Tokenization Startup Takes Off

a. What happened?

A Y Combinator-backed startup has launched a platform for talent tokenization, allowing individuals to tokenize and sell future earnings.

b. Why is it important?

Tokenizing talent democratizes access to investment in human potential and creates new opportunities for individuals to raise capital based on their future earnings.

Catch the full details here.

🦄 COMMUNITY SPOTLIGHT 🦄

🌟 TVVIN is utilizing Polkadot’s blockchain to scale its gold tokenization efforts, creating a more efficient and scalable solution for gold-backed digital assets. Read more here.

💼 Fortunafi has successfully completed a strategic funding round to expand its tokenization platform, driving innovation in the asset tokenization sector. Discover the details here.

🏢 Blocksquare has announced a $100 million tokenization initiative for real estate assets, marking a significant milestone in the adoption of blockchain technology in real estate. Get the scoop here.

🛒 Hong Kong is testing the retail use of e-HKD, paving the way for digital currency integration into everyday transaction. Read more here.

🚀 Brickken has joined the PwC Scale Digital Assets Program, aiming to enhance its capabilities and expand its influence in the digital assets market. Find out more here.

🏢 RedSwan CRE is leading the way in commercial real estate tokenization, offering innovative solutions for the tokenization of commercial properties. Learn more here.

📈 According to Moody’s, the growth of tokenization hinges on the development of blockchain-powered secondary markets, essential for liquidity and market adoption. Read the full analysis here.

⚖ LEGAL AND REGULATORY ⚖

Asset Regulatory Tokenization: A New Era in 2024

a. What do we know?

A recent article from Reuters delves into the evolving landscape of asset tokenization, highlighting that regulators are increasingly recognizing and addressing the legal frameworks needed to support this growing trend. Key regulatory bodies are starting to provide clearer guidelines on how tokenized assets should be classified and traded.

b. Why is it important?

Regulatory clarity is crucial because it ensures legal certainty for investors and businesses, reducing risks associated with compliance. This encourages wider adoption by providing a more secure and predictable environment for the issuance and trading of tokenized assets.

c. Why does it matter?

The involvement of regulators marks a significant step towards the mainstream acceptance of asset tokenization. By establishing clear rules and protections, it paves the way for greater innovation and participation in this market, ultimately leading to more efficient and inclusive financial systems.

Catch the full details here.

FMIs Aim to Drive Tokenized Asset Acceptance

a. What do we know?

Financial Market Infrastructures (FMIs) are actively working to promote the acceptance and integration of tokenized assets in traditional financial systems.

b. Why is it important?

The involvement of FMIs is crucial because they provide the backbone for financial markets, and their support can significantly boost the credibility and adoption of tokenized assets.

c. Why does it matter?

With FMIs driving this initiative, the path to widespread acceptance of tokenized assets becomes clearer, potentially leading to greater market stability and broader investment opportunities.

Explore more about this initiative here.

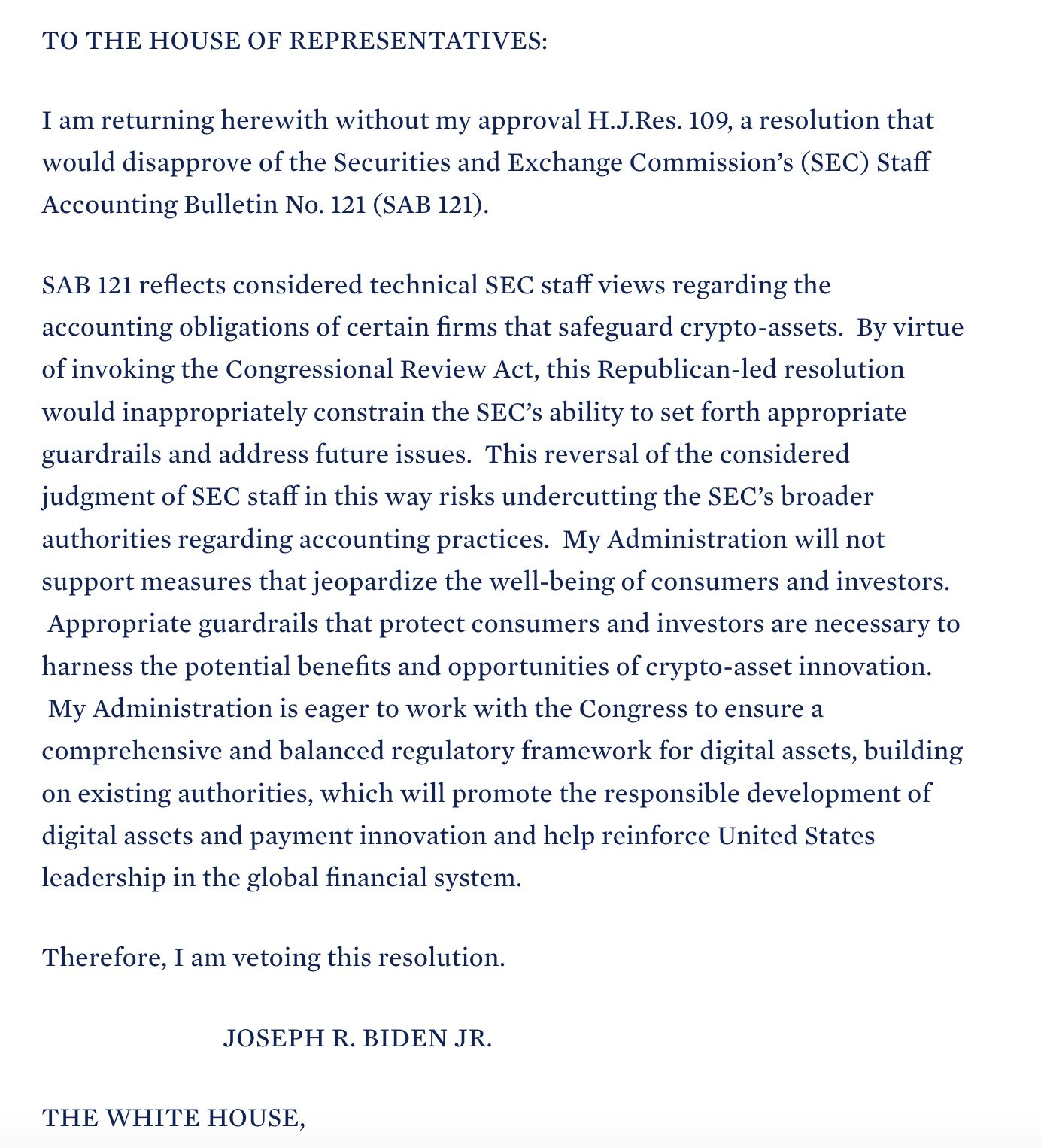

The President Shoots Down Crypto-Asset Law

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.XYZ, who is making waves in the world of Tradfi using tokenization as his battering ram. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

P.S. Whenever you're ready, there are 4 ways I can help you:

#1: Ready to tokenize your business, real estate or assets and its $5 million or more? Let's chat. >>> Click here to apply for your call with me

#2: Have you seen my YouTube Channel? I'm putting a ton of energy into creating heaps of valuable content that I think you'll like. Come check out my latest Tokenization Videos, and give me a like and subscribe.

#3: Promote your brand to over 5500 subscribers by sponsoring this newsletter.

#4: Follow me on Twitter and LinkedIn for more operating systems, marketing tips, and community-building systems.