BREAKING: The SEC’s New Rulebook for Tokenized Real Estate

Hello Tokenization Insiders,

Just days ago (on January 26, 2026), the U.S. Securities and Exchange Commission (SEC) dropped fresh guidance on tokenized securities and yes, that includes those shiny new tokens representing real estate assets. If you’re an asset owner eyeing the blockchain or an investor holding digital deeds, it’s time to pay attention.

The SEC is effectively saying: “Tokenization isn’t a free pass here’s how to play by the rules.” The tone is confident (surprisingly open-minded, even) but make no mistake: the SEC still expects you to dot your i’s and cross your t’s, even in the metaverse of real estate.

Key Takeaways

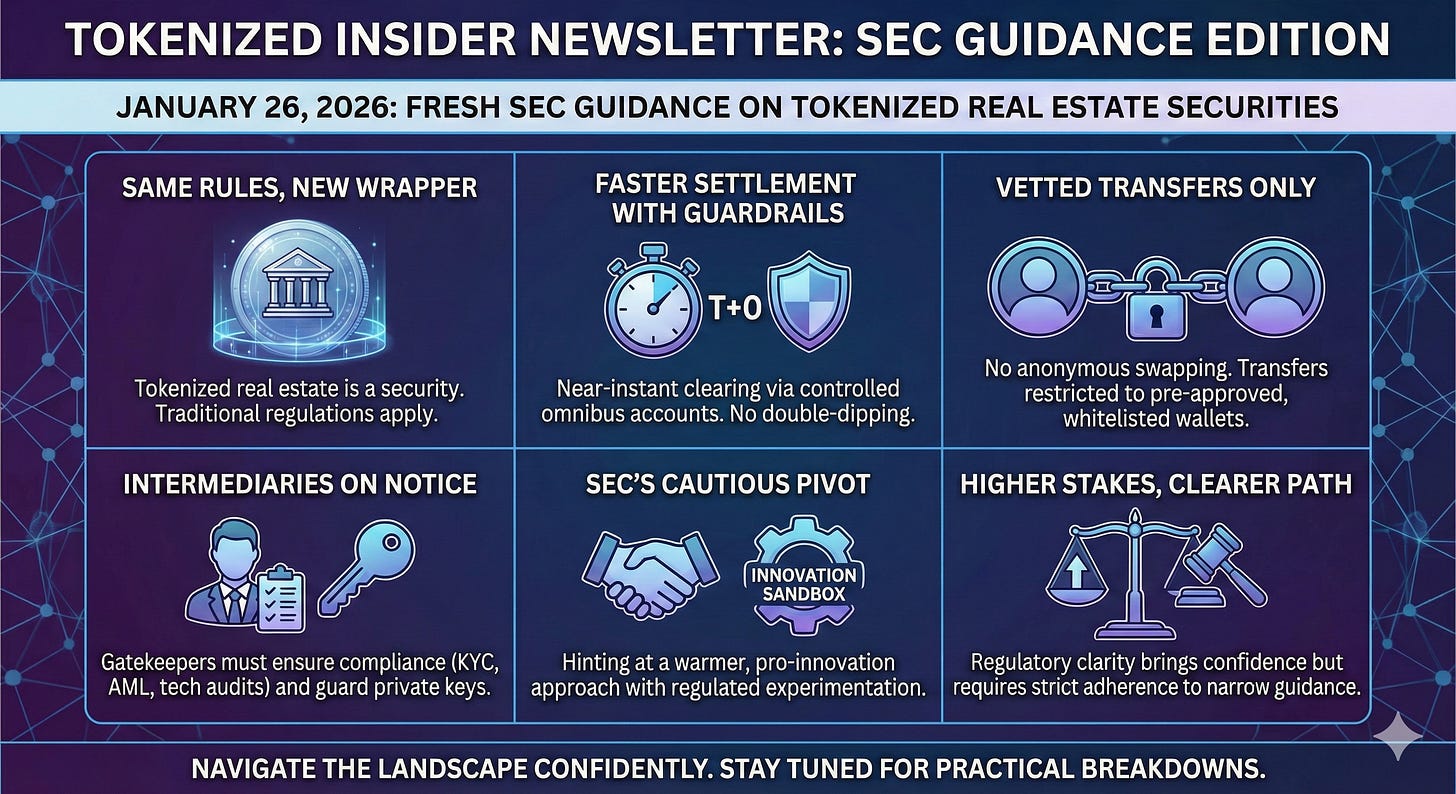

Tokenized real estate must play by all the traditional rules (and then some). The SEC’s latest guidance makes clear that putting a property share on a blockchain does not change its legal nature as a security the token is just a techie new wrapper, not a get-out-of-jail-free card on regulations.

Clearing & Settlement are speeding up with guardrails. The SEC is piloting near-instant “T+0” settlement for tokenized securities, touting reduced risk and 24/7 trading. But this isn’t a Wild West free-for-all; trades still settle through a controlled digital omnibus account to prevent double-dipping on assets. In plain English: yes, your token transaction can clear faster, but the back-end is carefully watching to ensure no one’s selling the same piece of a building twice.

Transfers won’t be a free-for-all. Forget about anonymously swapping real estate tokens with any stranger on a public blockchain. Transfer restrictions are the name of the game. The SEC-backed pilot requires that tokens move only between vetted, pre-approved wallets. That means any platform dealing in tokenized property better whitelist its investors and enforce holding periods or other limits, no ifs, ands, or buts.

Intermediaries (yes, the middlemen) have marching orders. Broker-dealers, exchanges, and other facilitators aren’t being sidelined by tokenization the SEC is in fact leaning on them to uphold strict compliance. From know-your-customer (KYC) checks and anti-money-laundering filters to nerd-level tech audits of blockchain systems, intermediaries must ensure the new tokens meet the same investor protection standards as old-school stocks. One new twist: if brokers custody your tokens, the SEC expects them to guard private keys like Fort Knox (no one else should even touch those keys). In short, the gatekeepers are still gatekeeping now with crypto custody policies and emergency “off switches” for when things go wrong.

A shift in the SEC’s stance, cautiously pro-innovation? In a plot twist few saw coming, the SEC is hinting at a warmer approach to blockchain innovation. One official openly admitted the SEC “had resisted crypto” and declared “this situation must end,” unveiling a plan for an “innovation exemption” sandbox to let experiments run under watch. The agency even rebranded its Crypto unit to a friendlier-sounding “Project Crypto.” Don’t get it wrong: the SEC hasn’t turned into a hype man for every token startup, but it is cracking the door open for regulated experimentation a notable change from the all-out courtroom battles of recent years.

Risks and opportunities for tokenized real estate are both higher now. The good news: regulatory clarity can bring in bigger players and more confidence – imagine easier fundraising and maybe one day trading fractions of a skyscraper as easily as stocks. The catch: step out of line, and the SEC will be on you faster than you can say “blockchain.” The guidance is narrow and very specific. It does not cover every token project so real estate sponsors going rogue without no-action relief or exemption could face enforcement. In short, tokenization’s door is open, but only for those who respect the rules.

Now, let’s break down what all this means in practice and how you can navigate this new landscape confidently (with a dash of humor to keep things light).