Breaking Barriers: Johnney Zhang's $52 Million Journey in Tokenizing Real Estate Across Continents

Ever imagined a world where #realestate investment is for everyone? Smartblocks makes it a reality! Discover the power of #tokenization & its benefits for early investors

Join us Mar 12 Webinar Signups (9 AM PST) https://bit.ly/Smartblocks4US

🔒 NEED TO KNOW 🔒

Two recent developments highlight the significant strides being made in this space, showcasing the potential of tokenization to revolutionize traditional markets.

DigiShares introduces DITO, a pioneering project designed to make real estate investments more accessible through tokenization. This initiative is set to break down traditional barriers to investment, offering a more inclusive and democratized approach to the real estate market.

DITO is not just a platform but a foundational layer that promotes standardization and interoperability among various participants in the tokenization ecosystem, including KYC/accreditation providers, security token platforms, exchanges, and decentralized applications (dApps).

Claus Skaaning, CEO of DigiShares, emphasizes the versatility and open nature of DITO, stating, "DITO consists of a base layer for DID enabling standardization and interoperability between framework participants (i.e. KYC/accreditation providers, security token platforms and exchanges, dApps)." He highlights the platform's adaptability to local regulations and its independence from any single company, protocol, or vendor ecosystem,” making it a universally applicable solution for tokenization.

HSBC Hong Kong, the largest bank in the region, is set to introduce tokenization services, marking a significant move by a major financial institution into the realm of digital assets.

This initiative aims to tokenize a variety of assets, including real estate, enabling investors to engage in fractional ownership and potentially transforming the landscape of asset investment.

HSBC's move into tokenization reflects a growing recognition of the technology's potential to enhance liquidity and accessibility in traditional investment markets.

These developments underscore the growing interest and confidence in tokenization as a transformative tool for investment and asset management, promising to open up new avenues for investors and redefine the parameters of traditional markets.

📈INVESTMENT OPPORTUNITIES 📈

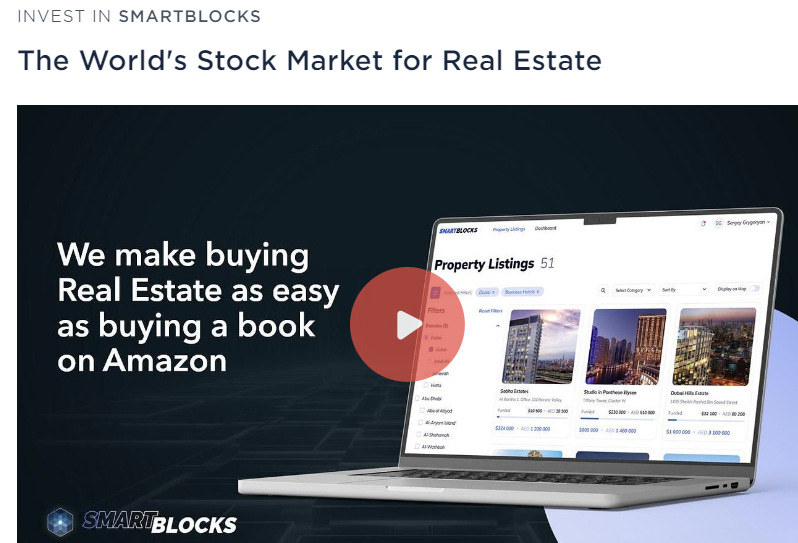

Smartblocks is on Wefunder!

The Coinbase for Real Estate

80% of Millennials/Gen Z can’t afford real estate and nearly 99.9% of people globally can’t invest in the $80 Trillion real estate market. We created a platform similar to Airnbnb that tokenizes any type of real estate from around the world and allows anyone to invest for as low as $50. Now we’re giving people access to real estate that otherwise couldn’t afford it worldwide. Invest in SmartBlocks on Wefunder now.

This Man has Tokenized $52 Million in Real Estate

Johnney Zhang's journey in the real estate and investment sector is a compelling narrative of resilience, focus, and pioneering innovation. With a portfolio that includes managing over $1 billion in real estate assets and developing luxury properties worth over $500 million in Southern California, Zhang has solidified his expertise and vision in the field. His venture into the revolutionary realm of real estate tokenization has already achieved significant milestones, with over $52 million in assets tokenized, democratizing real estate investment and enabling global access with as little as $1.

This journey, spanning 4,191 days and overcoming three failed businesses, reflects a relentless pursuit of innovation and a deep commitment to transforming the real estate investment landscape. Zhang's story is not just about financial success but about a strategic, long-term vision to empower individuals worldwide.

💰 DEALS 💰

In the evolving landscape of asset tokenization, several initiatives are setting new standards for how traditional assets are managed and traded digitally. Here's a straightforward analysis of why these particular deals are noteworthy in the sector.

RealtyX's Platform Launch and ETH Raffle

RealtyX has launched a platform that introduces a novel way of engaging with real estate investments, highlighted by a 10 ETH raffle for token holders. Read more

The platform aims to make real estate investment more accessible, utilizing Ethereum blockchain to facilitate entry for a wider range of investors.

Chainlink's Collaboration with Financial Institutions

Chainlink's partnership with Goldman Sachs, Citigroup, and HSBC represents a significant integration of blockchain technology into the traditional banking sector, focusing on the tokenization of real assets. Read more

This collaboration highlights the growing interest in using blockchain for more efficient, transparent, and secure asset transactions, potentially transforming how assets are managed and traded.

Ripple and Zoniqx's Strategic Partnership

This partnership aims to enhance the tokenization of real-world assets on the XRP Ledger, indicating a focused effort to expand the utility of blockchain beyond traditional cryptocurrencies. Read more

By utilizing the XRP Ledger, Ripple and Zoniqx are working towards creating a more efficient and scalable platform for asset tokenization, which could significantly improve the liquidity and accessibility of various asset classes.

💡 EXPERT INTERVIEWS 💡

Revolutionizing Art with Blockchain: Insights from 10101ART's Founder

Art tokenization is a recent trend in the art world that leverages blockchain technology transforming the ownership rights of an artwork into digital tokens.

10101.art is a platform where people can become legal owners of physical paintings created by world-renowned artists such as Warhol, Dali. Picasso, Banksy and others.

The Inside Story of the World’s First Registered Security Token

INX’s Bob Ejodame discusses what the firm is doing and where they are headed.

🦄 COMMUNITY SPOTLIGHT 🦄

In this edition of "Community Spotlight," we delve into the evolving landscape of tokenized assets, highlighting the roles of prominent entities and offering insights into how these developments impact the broader community.

Banks to Dominate Tokenized Real-World Assets, Says ACRA

Banks' existing regulatory frameworks and customer bases position them as primary players in the tokenization space.

Securitize Pioneers Credit Lending Against Tokenized Assets

This innovation offers a new liquidity avenue for asset holders, enhancing the utility of tokenized assets.

Ravencoin Leads the Charge in Tokenizing Assets on Bitcoin Network

Ravencoin's focus on asset tokenization introduces a novel use case for the Bitcoin network, potentially broadening its appeal.

Union Investment Taps Blockchain for Fund Management

Blockchain adoption by traditional fund managers like Union Investment signals a shift towards more efficient, transparent operations.

Shifting Focus to Real-World Assets in the Crypto Space

Tokenization of real-world assets is seen as a key growth area for the crypto industry, offering tangible value beyond speculative trading.

Citibank Explores Tokenization of Private Equity Funds

Citibank's exploration into tokenization reflects a growing interest in making exclusive investment opportunities more accessible to a wider audience.