BlackRock Racing to Tokenize Everything

🔒 NEED TO KNOW 🔒

1. BLACKROCK: How to spend money and influence people

BlackRock's venture into creating a tokenized fund in partnership with Securitize marks a significant endorsement of the crypto and tokenization space by the world's largest asset manager. This collaboration underscores the growing acceptance and integration of blockchain technology and tokenization in mainstream financial services. The move could catalyze a broader adoption of tokenization, offering a new avenue for investing in real-world assets through digital tokens.

Five Key Points Relevant to the Tokenization Space:

BlackRock's Entry into Tokenization: The world's largest asset manager, BlackRock, has filed with the SEC to offer a fund in partnership with Securitize, indicating strong institutional interest in the tokenization of assets.

Partnership with Securitize: Securitize, known for its focus on the tokenization of real-world assets, gains a significant boost through its partnership with BlackRock, highlighting the potential for tokenization to bridge traditional finance and blockchain.

$100 Million Seed in USDC: The fund's seeding with $100 million in USDC stablecoin on the Ethereum network showcases the practical use of cryptocurrency in significant financial ventures and the trust in stablecoins for large-scale investments.

Focus on Real-World Asset Tokenization: The collaboration between BlackRock and Securitize emphasizes the growing trend of tokenizing real-world assets, offering investors new opportunities and enhancing liquidity in various asset classes.

Catalyst for Broader Adoption: Like the Bitcoin ETF, BlackRock's move could serve as a catalyst for the broader adoption of tokenization technology, potentially transforming how investments are made and how assets are managed globally.

These developments are pivotal, not just for those directly involved in the tokenization space, but for the entire landscape of investment and asset management, signaling a shift towards more innovative, flexible, and inclusive financial systems.

2. CoinGecko’s Mega Report on Tokenization

The CoinGecko RWA Report 2024 doesn't just dip its toes but dives headfirst into the crypto pool, revealing how Real World Assets (RWAs) are not just flirting with the blockchain but are in a full-blown love affair.

From the humble beginnings of fiat-backed stablecoins to the tokenization of everything from your grandmother's house to the Mona Lisa, this report is a treasure map for navigating the burgeoning confluence of traditional assets and digital wizardry.

It's a call to investors and skeptics alike: the future of finance is being rewritten, and it's spelled T-O-K-E-N-I-Z-A-T-I-O-N.

Three Key Points from the RWA Report 2024:

Dominance of USD-Pegged Stablecoins: USD-pegged assets continue to dominate the fiat-backed stablecoin market, with Tether (USDT), USDC, and Dai (DAI) comprising 95% of the market. This dominance underscores the critical role of stablecoins in providing a stable medium of exchange within the volatile crypto market.

Growth of Commodity-Backed Tokens: The market capitalization for commodity-backed tokens has reached $1.1 billion, with gold remaining the most popular commodity. This growth reflects an increasing interest in tokenizing physical assets, offering investors a novel way to gain exposure to commodities within the crypto space.

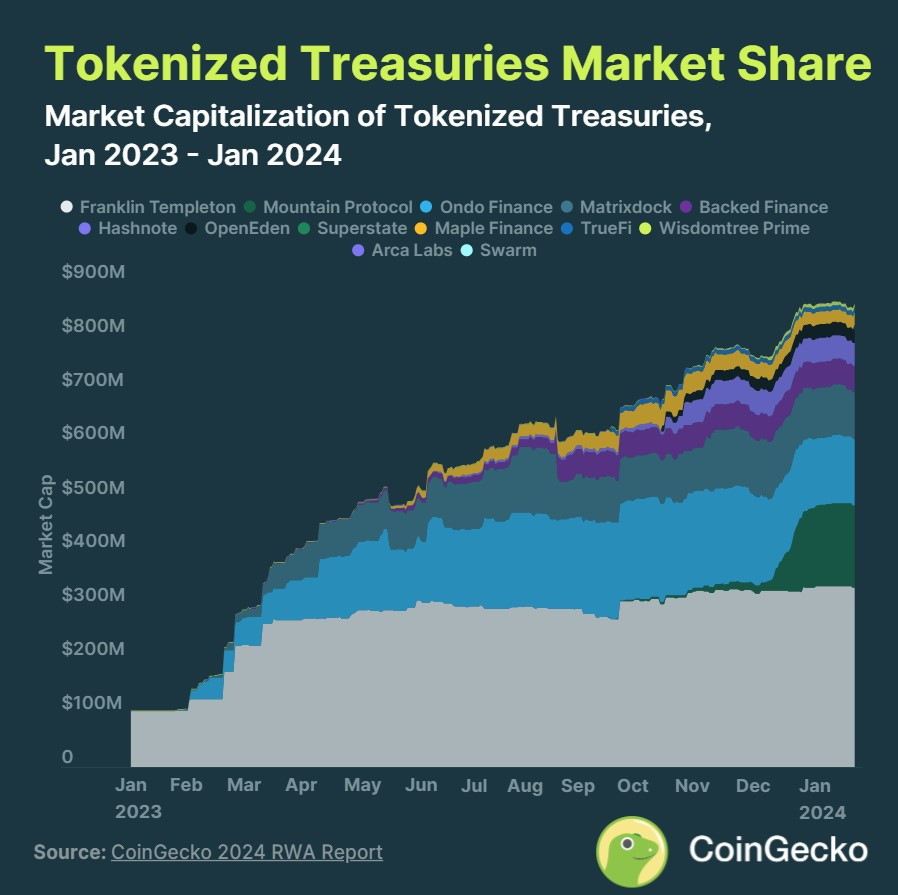

Surge in Tokenized Treasury Products: Tokenized US treasuries experienced a significant surge, growing 641% in 2023 to over $861 million. This trend highlights the growing appeal of blockchain-based financial instruments as alternatives to traditional investment vehicles, especially in times of financial uncertainty.

3. SEC Loses Again in Court - Ordered to Pay Fines

In short, the SEC's been on the losing side more than they'd like lately, especially in the digital arena, and it's costing us, the taxpayers. Plus, with the judge's scathing feedback, it's clear there's some rethinking needed on their end.

The straight scoop:

The SEC's Taking Hits: Rep. French Hill points out the SEC is getting a bit of a whooping in court lately, especially with digital assets, and DEBT Box is just the latest black eye. "The agency is now getting trampled by the federal courts," as Hill puts it, highlighting a trend where the SEC isn't just losing in court but also paying for it—literally, with taxpayer money covering legal fees.

Judge's Sharp Rebuke: A Utah judge, Robert Shelby, didn't mince words, saying the SEC acted in "bad faith" against DEBT Box, even slapping them with sanctions and attorney's fees. Shelby's calling out the SEC's misleading statements is a significant embarrassment, especially when he notes, "the agency admitting that it had fallen short of expectations."

Not Just One Off: This isn't a one-hit wonder of SEC setbacks; Hill reels off other courtroom defeats like Grayscale and Ripple, showing a pattern of the SEC not quite getting its way. Plus, with high-profile cases against big names like Coinbase and Binance still in the wings, it's clear the SEC's dance card is full, but maybe not in the way they'd hoped.

4. SEC Trying to Classify Ethereum as a Security

The SEC's latest maneuver puts Ethereum and the broader crypto ecosystem in a precarious position, with potential regulatory battles on the horizon and the industry's fate hanging in the balance. With tokenization, we’ve already made the security leap so it will have relatively low impact on us.

The straight scoop:

SEC's Ether Ambush: The SEC's got its sights set on Ether, slinging subpoenas at U.S. companies to gather ammo for potentially tagging Ether as a security. This move comes after Ethereum's shift to proof-of-stake, with the SEC playing coy on Ether's status despite previously not labeling it a security alongside Bitcoin.

Crypto's Legal Limbo: With SEC Chair Gary Gensler keeping his cards close to his chest on Ether's classification, the crypto world's left guessing. The SEC's green light on Ether futures ETFs but silence on spot ETH ETFs has everyone on edge, expecting a verdict by May.

Regulatory Tug-of-War: This Ether saga could spark a showdown between the SEC and the Commodity Futures Trading Commission (CFTC), as both agencies vie for control over the crypto space. Despite efforts to clear the regulatory fog, Congress hasn't yet passed legislation to define the boundaries for digital assets.

🏙 REAL ESTATE 🏙

5. Deutsche Börse's Digital Assets Expansion:

Deutsche Börse expands its digital frontier with a new Digital Assets Business Platform, aiming to make tokenized real estate assets more accessible to institutional customers, thereby capitalizing on the trend of digital securities and tokenization.

6. Red Swan's Tokenization Move with Polymath: A Game Changer?

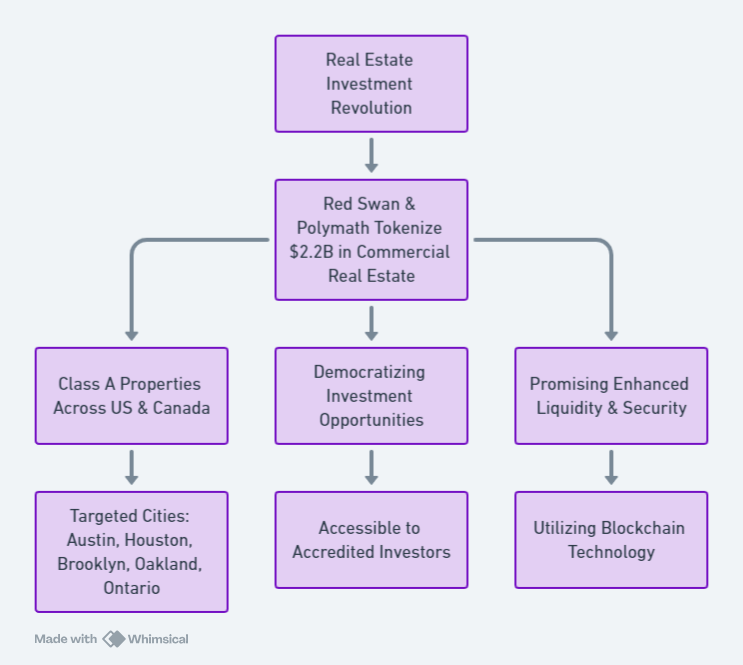

Tokenizing $2.2 Billion in Real Estate: Red Swan's collaboration with Polymath has led to the tokenization of $2.2 billion in Class A commercial properties across the US and Canada, offering a new avenue for real estate investment. Read more

Why It Matters: This venture not only democratizes access to premium real estate investments but also challenges traditional barriers to entry, promising enhanced liquidity and security through blockchain technology.

📈INVESTMENT OPPORTUNITIES 📈

7. Unicoin's Debut on INXONE: A Smart Bet?

Unicoin Hits INXONE: Launching on a regulated platform, Unicoin aims to blend digital asset excitement with a layer of security. It's a bold step into a space craving legitimacy.

Why Consider It? Regulation offers a safety net, yet the crypto rollercoaster isn't for everyone. Before diving in, weigh the thrill against the unpredictable tides of the market.

🦄 COMMUNITY SPOTLIGHT 🦄

🌐 Israel's Transparency Triumph in Government Bond Tokenization

Israel's Ministry of Finance and the Tel Aviv Stock Exchange's successful proof of concept for DLT-based government bonds, involving major banks like Barclays and JP Morgan, highlights transparency and efficiency as key benefits.

Read the full article

🏦 FDIC Vice Chairman on the Brink of Banking's New Era

FDIC Vice Chairman Travis Hill discusses the transformative potential and challenges of tokenizing assets, emphasizing the need for regulatory clarity in the evolving landscape of digital assets.

Read the full article

🔓 The Looming Threat of the Largest Bank Heist in History

Highlighting the risks associated with the tokenization of real-world assets by major banks, this article warns of potential cybersecurity vulnerabilities in the financial system's future.

Read the full article

🔐 Polymesh Association Launches Polymesh Private

Polymesh Association introduces Polymesh Private, a new blockchain platform aimed at financial institutions, promising enhanced confidentiality and regulatory compliance in asset tokenization.

Read the full article

💰 Figure's $60M Leap Towards a Decentralized Financial Future

Figure Technologies, backed by Jump Crypto, Pantera Capital, and Lightspeed Faction, aims to revolutionize the crypto exchange landscape with its decentralized platform, Figure Markets.

Read the full article

🔮 STATS 🔮

The Threat of Digital Heists: "The top four custodian banks are in the process of tokenizing over $108 trillion in assets, highlighting significant cybersecurity risks in the financial system." Read more

Figure's Crypto Exchange Ambition: "Figure Technologies secures $60 million from leading crypto investors to build a decentralized crypto exchange platform." Read more

BlackRock's Tokenization Trailblazing: "BlackRock and Securitize partner to tokenize $100 Million in assets, marking a significant shift towards digital investment platforms." Read more

Red Swan's Real Estate Revolution: "Red Swan has tokenized $2.2 billion in commercial real estate through Polymath, heralding a new era for property investment with blockchain technology." Read more

🎯AUTHOR BIO 🎯

Meet Mark Fidelman, the tech-savvy founder of SmartBlocks.XYZ, who is making waves in the world of Tradfi using tokenization as his battering ram. With a background in technology sales, marketing, and customer experience, Mark has been instrumental in driving growth for organizations such as NFT leader WAX.io.

P.S. Whenever you're ready, there are 4 ways I can help you:

#1: Ready to tokenize your business, real estate or assets and its $5 million or more? Let's chat. >>> Click here to apply for your call with me

#2: Have you seen my YouTube Channel? I'm putting a ton of energy into creating heaps of valuable content that I think you'll like. Come check out my latest Tokenization Videos, and give me a like and subscribe.

#3: Promote your brand to over 5500 subscribers by sponsoring this newsletter.

#4: Follow me on Twitter and LinkedIn for more operating systems, marketing tips, and community-building systems.